Technology is moving at an incredible pace, and for marketing leaders, staying up to date is crucial for remaining competitive. However, traditional news sources are no longer the only source of information. With the rise of digital tech-focused TV channels and streams, the way media is consumed, relied upon, and utilized is changing almost as rapidly as the technology powering it.

To find out what 4,485,377 marketing leaders in America’s opinions were about technology news media, we utilized AI-driven audience profiling to synthesize insights from online discussions for a year, ending August 11, 2025, to a high statistical confidence level. The results reveal current trends and the impact the media has on marketing and business decisions.

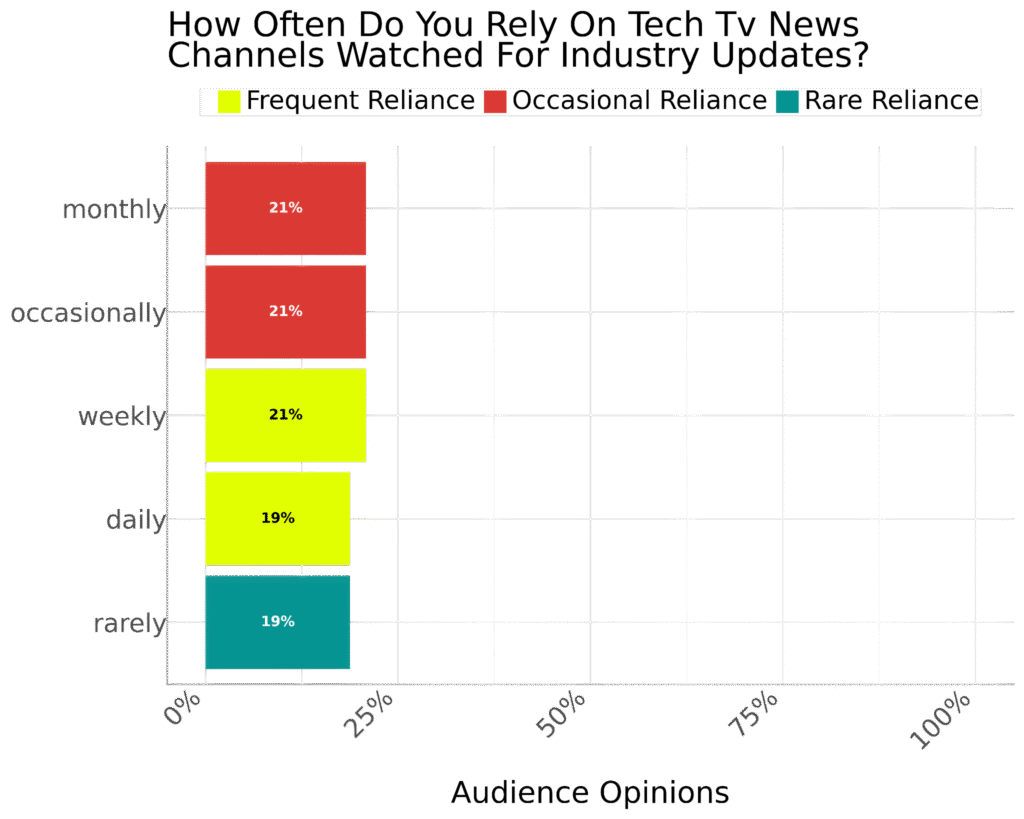

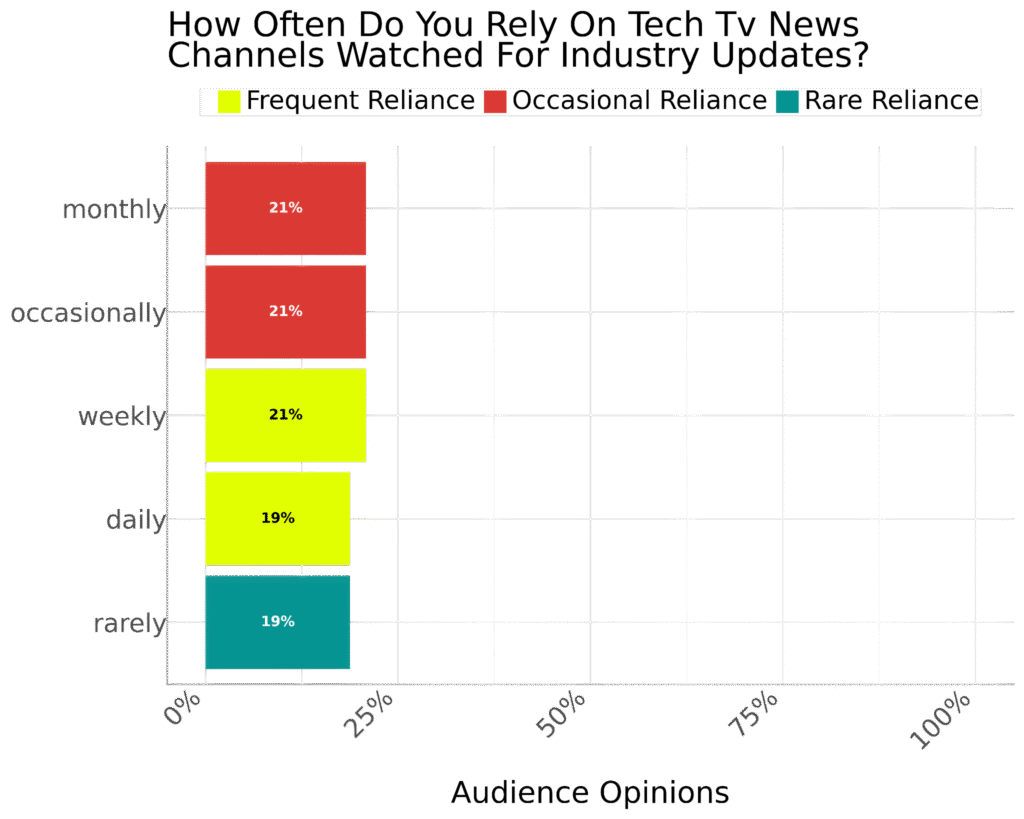

Fewer than a quarter of marketing leaders in our audience said that they regularly watch tech TV news channels for industry updates. Among those who indicated an occasional reliance on TV news updates, 21% said they watched monthly, while another 21% said they watched occasionally. Some indicated frequent reliance on this medium, relying on it frequently every week, while 19% said they watched tech TV news for daily updates. Another 19% said they rarely relied on this medium.

These insights are more or less in line with a 2025 Deloitte survey, which found Americans spend an average of six hours with media and entertainment content daily. However, the type of content and the activities performed during this time vary by generation. While Boomers spend 1.4 hours watching TV shows or movies on streaming video services and 2.1 hours watching TV shows or movies on cable or live-streaming TV services, Millennials spend 1.5 hours and 0.9 hours on the same activities.

This suggests the majority of marketing leaders generally turn to other sources for industry updates, while those who rely on tech TV news channels may be influenced by the behavior of their peers.

Fewer than a quarter of marketing leaders in our audience said that they regularly watch tech TV news channels for industry updates. Among those who indicated an occasional reliance on TV news updates, 21% said they watched monthly, while another 21% said they watched occasionally. Some indicated frequent reliance on this medium, relying on it frequently every week, while 19% said they watched tech TV news for daily updates. Another 19% said they rarely relied on this medium.

These insights are more or less in line with a 2025 Deloitte survey, which found Americans spend an average of six hours with media and entertainment content daily. However, the type of content and the activities performed during this time vary by generation. While Boomers spend 1.4 hours watching TV shows or movies on streaming video services and 2.1 hours watching TV shows or movies on cable or live-streaming TV services, Millennials spend 1.5 hours and 0.9 hours on the same activities.

This suggests the majority of marketing leaders generally turn to other sources for industry updates, while those who rely on tech TV news channels may be influenced by the behavior of their peers.

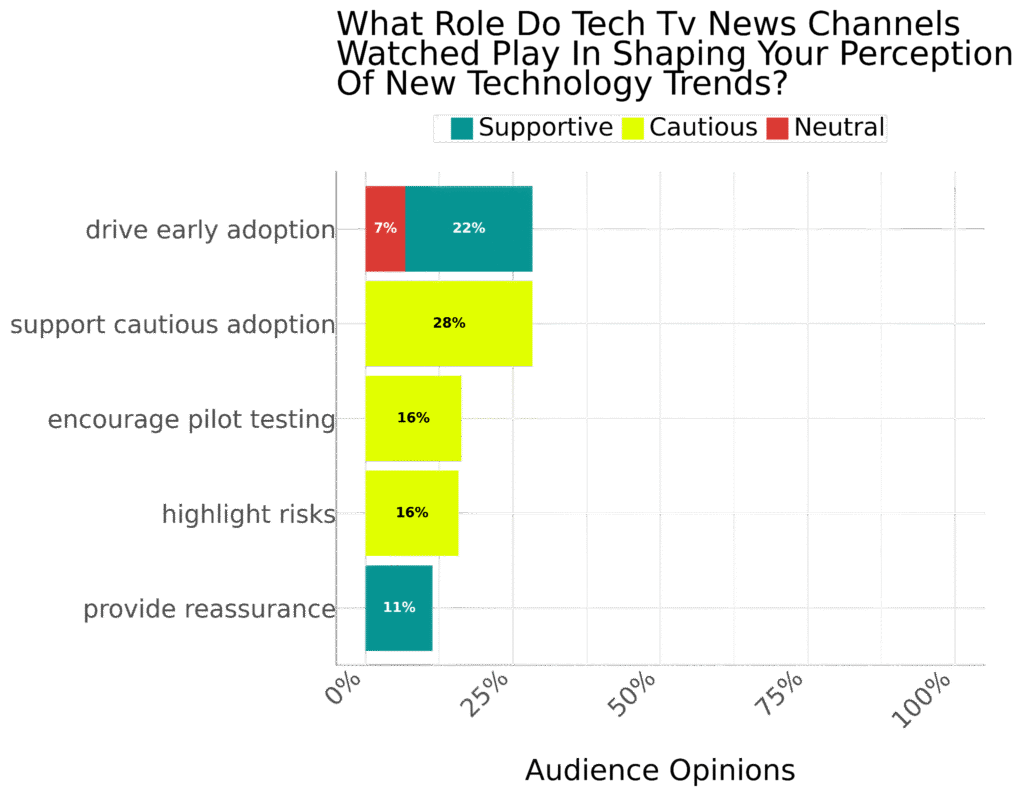

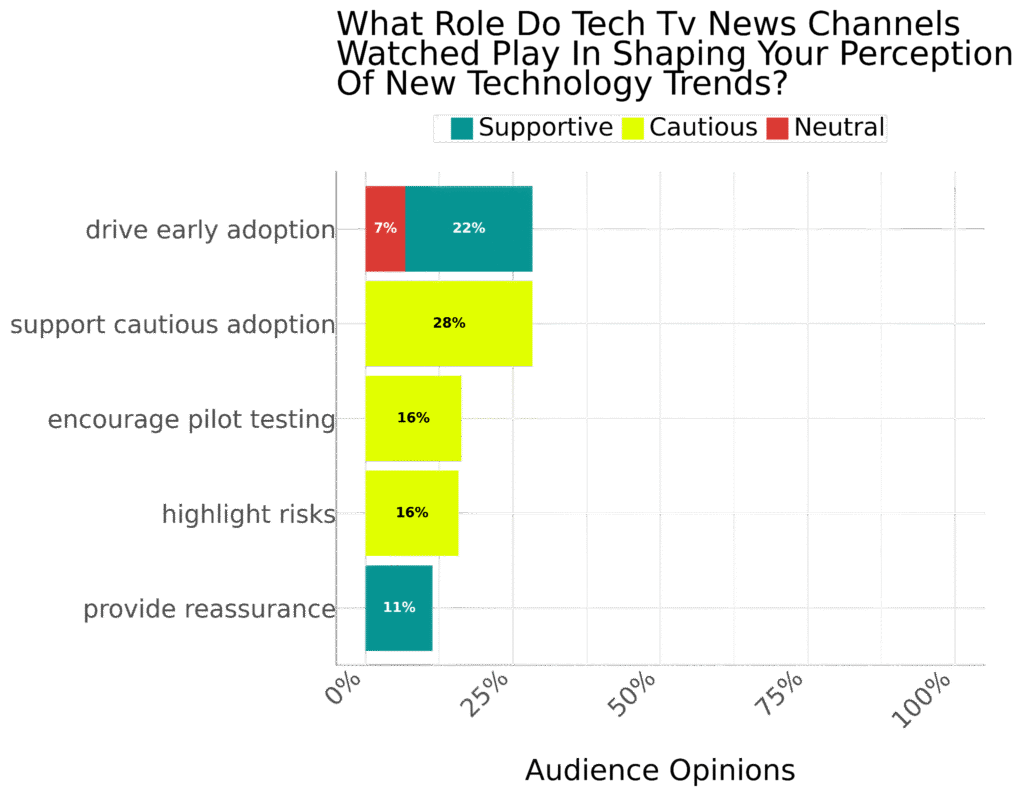

There are a variety of perspectives regarding the role of tech TV news channels in shaping American marketing leaders’ perceptions of new technology trends. At 28%, the largest proportion of our audience said news channels encouraged them to support cautious adoption of new trends or technologies.

However, 7% had neutral feelings about TV news driving early adoption, while 22% said TV news supportively drove early adoption. 16% were cautious about TV news media encouraging pilot testing, and another 16% shared this feeling about news channels’ highlighting of risks. 11% said tech TV news channels were supportive in providing reassurance.

These findings may reflect the growing disinterest in news overall, as revealed in the 2024 Reuters Institute for the Study of Journalism Digital News Report. According to the report, only 46% of respondents said they were either extremely or very interested in news, marking a 27% decline since 2016.

The general lack of interest in news has potentially serious ramifications for societies, such as a potential decline in democratic engagement, which requires political interest and knowledge, and not being able to identify or counter misinformation.

In the context of marketing leaders and their work, a disinterest in news could have similar consequences, namely losing track of what’s happening in their industries and in the wider business world, and falling victim to misinformation, which could result in potentially disastrous business decisions.

There are a variety of perspectives regarding the role of tech TV news channels in shaping American marketing leaders’ perceptions of new technology trends. At 28%, the largest proportion of our audience said news channels encouraged them to support cautious adoption of new trends or technologies.

However, 7% had neutral feelings about TV news driving early adoption, while 22% said TV news supportively drove early adoption. 16% were cautious about TV news media encouraging pilot testing, and another 16% shared this feeling about news channels’ highlighting of risks. 11% said tech TV news channels were supportive in providing reassurance.

These findings may reflect the growing disinterest in news overall, as revealed in the 2024 Reuters Institute for the Study of Journalism Digital News Report. According to the report, only 46% of respondents said they were either extremely or very interested in news, marking a 27% decline since 2016.

The general lack of interest in news has potentially serious ramifications for societies, such as a potential decline in democratic engagement, which requires political interest and knowledge, and not being able to identify or counter misinformation.

In the context of marketing leaders and their work, a disinterest in news could have similar consequences, namely losing track of what’s happening in their industries and in the wider business world, and falling victim to misinformation, which could result in potentially disastrous business decisions.

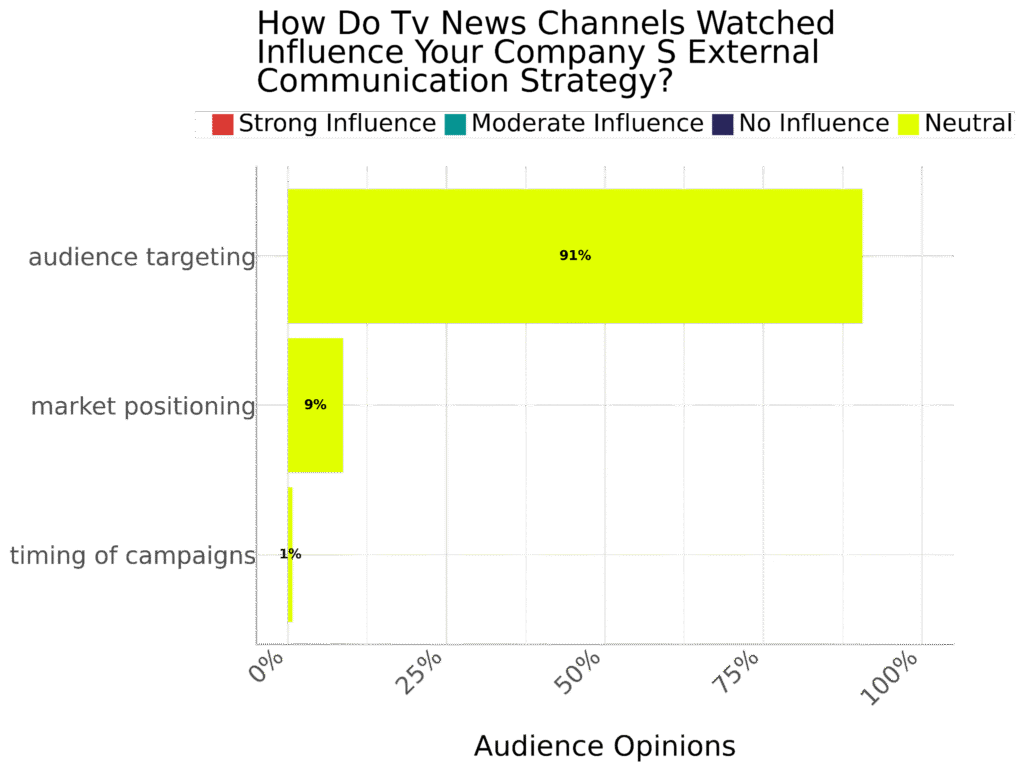

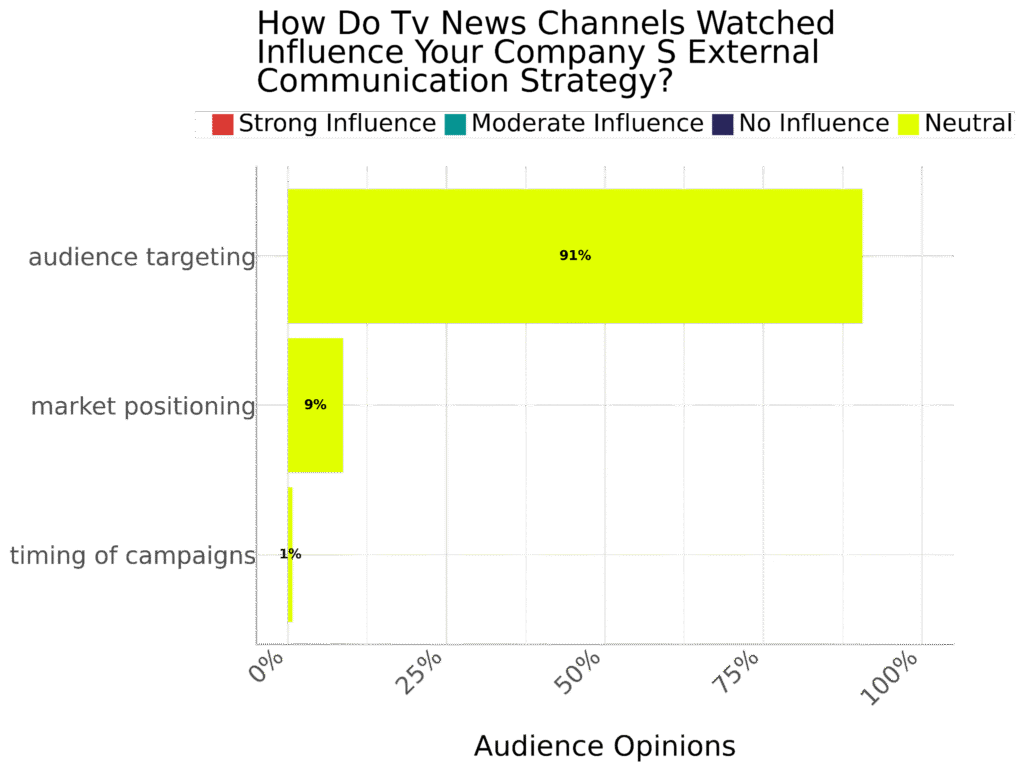

Our audience of US marketing leaders remained neutral regarding TV news channels’ influence on their companies’ external communication strategies, whether discussing audience targeting (91%), market positioning (9%), or campaign timing (1%). This suggests companies’ external communication strategies place greater focus on other channels, such as email or social media.

That our audience’s companies possibly focus on other communication platforms aligns with the findings and recommendations contained in a 2024 article published in the Educational Administration Theory and Practice journal. Acknowledging the many different communication channels available today, the article emphasizes that choosing the appropriate channel is essential if organizations want to communicate effectively.

Our audience of US marketing leaders remained neutral regarding TV news channels’ influence on their companies’ external communication strategies, whether discussing audience targeting (91%), market positioning (9%), or campaign timing (1%). This suggests companies’ external communication strategies place greater focus on other channels, such as email or social media.

That our audience’s companies possibly focus on other communication platforms aligns with the findings and recommendations contained in a 2024 article published in the Educational Administration Theory and Practice journal. Acknowledging the many different communication channels available today, the article emphasizes that choosing the appropriate channel is essential if organizations want to communicate effectively.

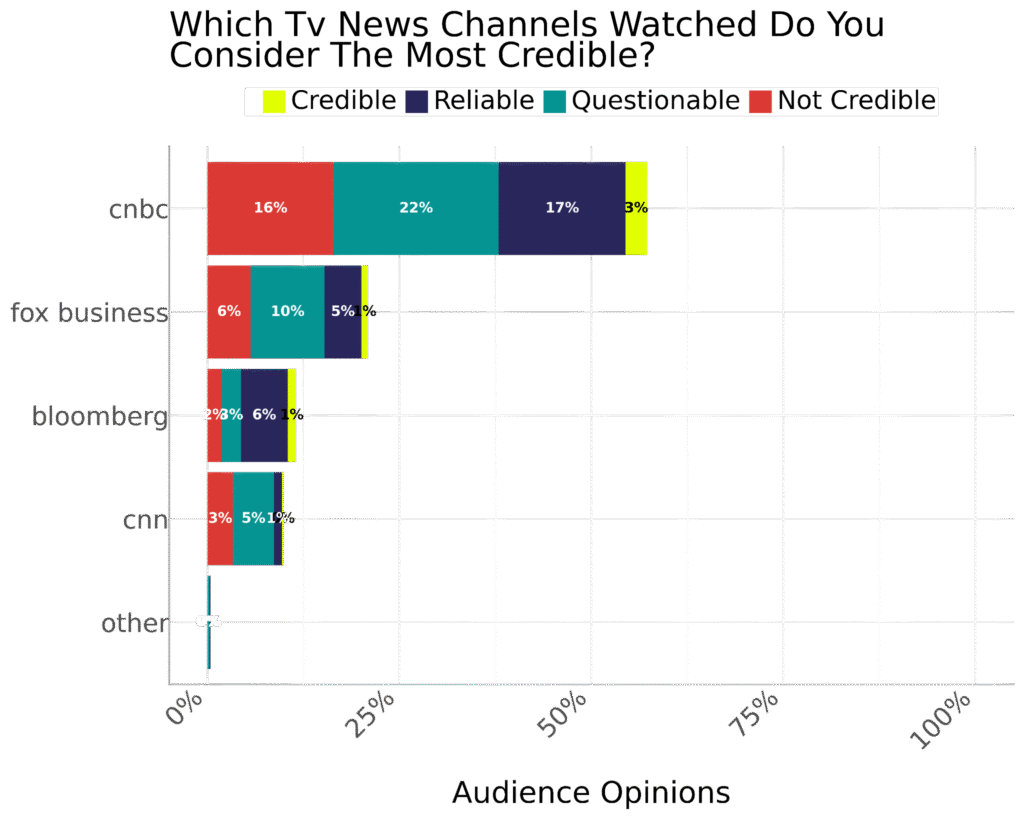

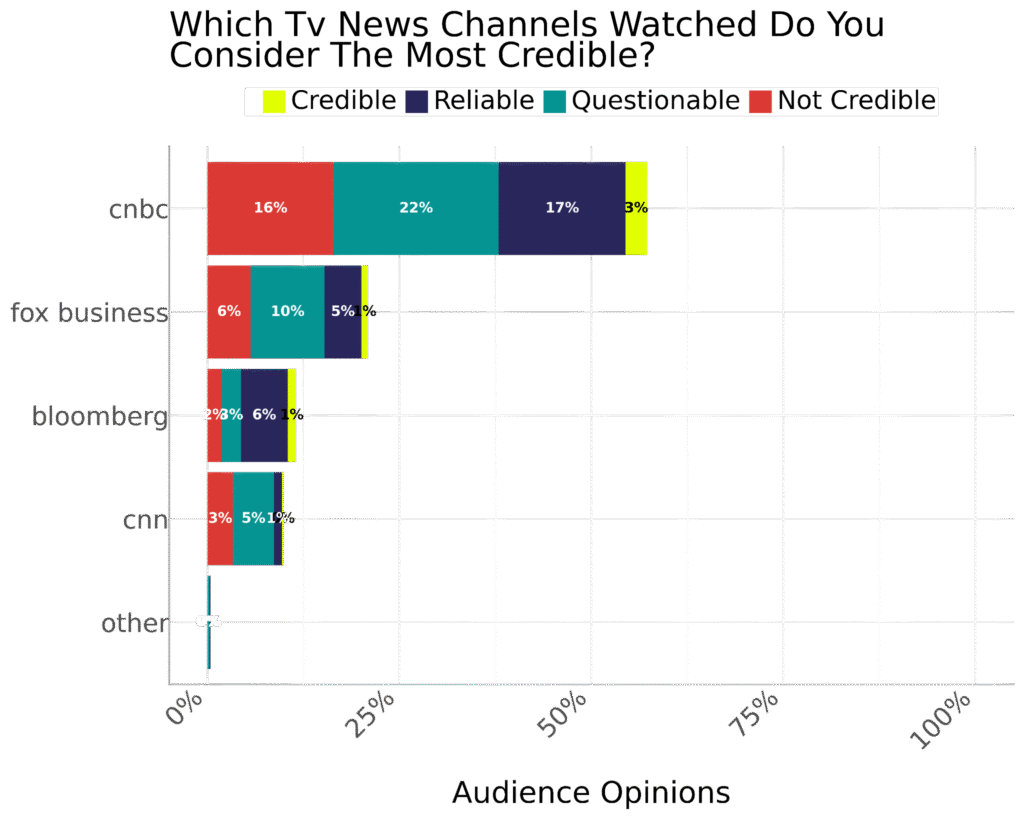

The varied opinions regarding which TV news channels US marketing leaders think are the most credible suggest our audience understands that not all channels are created equal. They were most vocal about CNBC, with 17% rating it as the most reliable, while 3% regarded it as the most credible. However, their appreciation was not shared by all, as 22% said CNBC was questionable, while 16% said the channel was not credible.

Among those who mentioned Fox Business, 5% said they thought it was reliable, but only 1% described it as credible. However, there was a greater number of opinions not in favor of this channel, with 10% saying it was questionable and 6% saying it wasn’t credible.

Bloomberg fared marginally better, with 1% saying it was credible and 6% describing it as reliable, while 2% said it wasn’t credible and 3% said the channel was questionable. CNN was the least regarded of the TV news channels mentioned, with no one saying it was credible. Instead, 3% said the channel wasn’t credible, 5% said it was questionable, and 1% said it was reliable.

Taking these diverse opinions into account, CNBC emerges as the most credible and reliable of TV news channels.

These insights tie in with what we mentioned above about the growing lack of trust in the media and disinterest in news, suggesting that marketing leaders are aware of potential negative biases or misinformation spread by some TV news channels.

Interestingly, a 2024 YouGov survey revealed that the most trusted news sources in America include The Weather Channel, BBC, PBS, The Wall Street Journal, and Forbes. CNBC (+2) ranked lower than Bloomberg (+7) and the same as CNN (+2). Fox Business (-2) was one of the least trusted.

The varied opinions regarding which TV news channels US marketing leaders think are the most credible suggest our audience understands that not all channels are created equal. They were most vocal about CNBC, with 17% rating it as the most reliable, while 3% regarded it as the most credible. However, their appreciation was not shared by all, as 22% said CNBC was questionable, while 16% said the channel was not credible.

Among those who mentioned Fox Business, 5% said they thought it was reliable, but only 1% described it as credible. However, there was a greater number of opinions not in favor of this channel, with 10% saying it was questionable and 6% saying it wasn’t credible.

Bloomberg fared marginally better, with 1% saying it was credible and 6% describing it as reliable, while 2% said it wasn’t credible and 3% said the channel was questionable. CNN was the least regarded of the TV news channels mentioned, with no one saying it was credible. Instead, 3% said the channel wasn’t credible, 5% said it was questionable, and 1% said it was reliable.

Taking these diverse opinions into account, CNBC emerges as the most credible and reliable of TV news channels.

These insights tie in with what we mentioned above about the growing lack of trust in the media and disinterest in news, suggesting that marketing leaders are aware of potential negative biases or misinformation spread by some TV news channels.

Interestingly, a 2024 YouGov survey revealed that the most trusted news sources in America include The Weather Channel, BBC, PBS, The Wall Street Journal, and Forbes. CNBC (+2) ranked lower than Bloomberg (+7) and the same as CNN (+2). Fox Business (-2) was one of the least trusted.

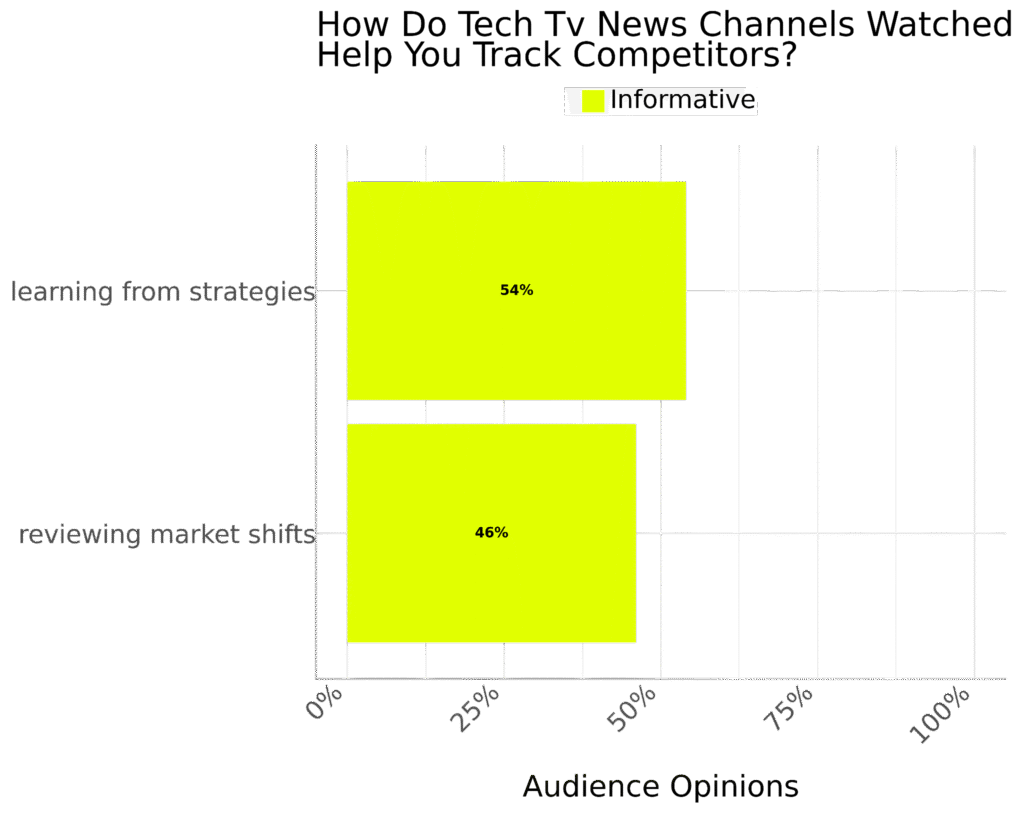

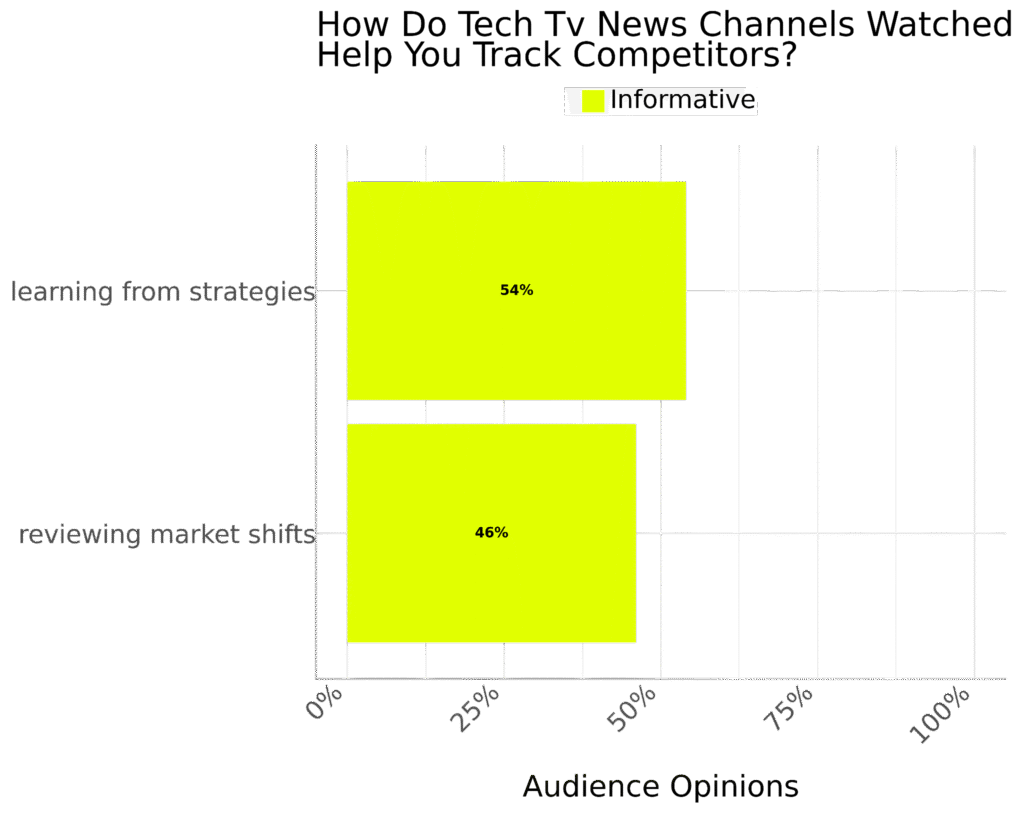

While some marketing leaders in the US don’t place much faith in tech TV news channels for industry updates or shaping communication strategies, they still find these platforms helpful. One of the ways in which news channels help our audience is in tracking competitors, although how this happens varies. 54% of our audience said they find news channels informative when learning from competitors’ strategies. For 46%, channels are informative sources of information when reviewing market shifts.

That slightly more than half of our audience uses tech TV news channels to learn from competitors’ strategies isn’t surprising. This may have been a popular approach in the past, but social media is now the preferred method of monitoring competitors.

According to Sprout Social, 90% of marketers agree that social data enables them to gain an advantage over their competitors, while 86% said they identify new business opportunities by using competitor insights from social media.

While some marketing leaders in the US don’t place much faith in tech TV news channels for industry updates or shaping communication strategies, they still find these platforms helpful. One of the ways in which news channels help our audience is in tracking competitors, although how this happens varies. 54% of our audience said they find news channels informative when learning from competitors’ strategies. For 46%, channels are informative sources of information when reviewing market shifts.

That slightly more than half of our audience uses tech TV news channels to learn from competitors’ strategies isn’t surprising. This may have been a popular approach in the past, but social media is now the preferred method of monitoring competitors.

According to Sprout Social, 90% of marketers agree that social data enables them to gain an advantage over their competitors, while 86% said they identify new business opportunities by using competitor insights from social media.

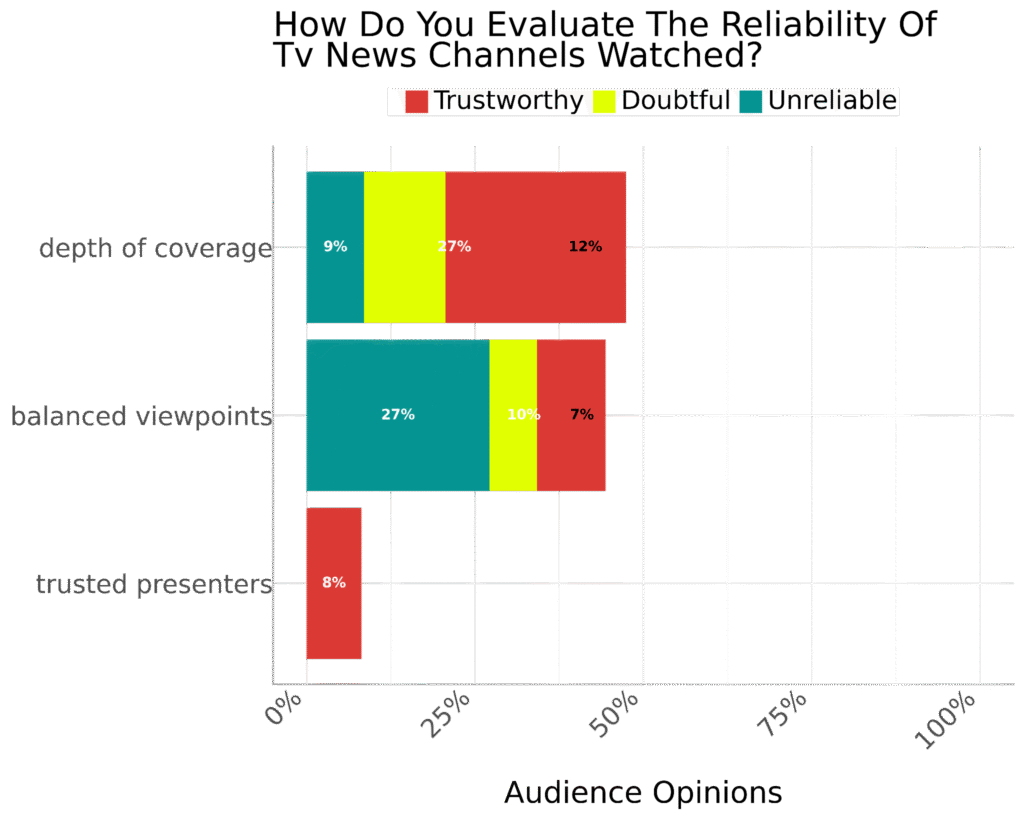

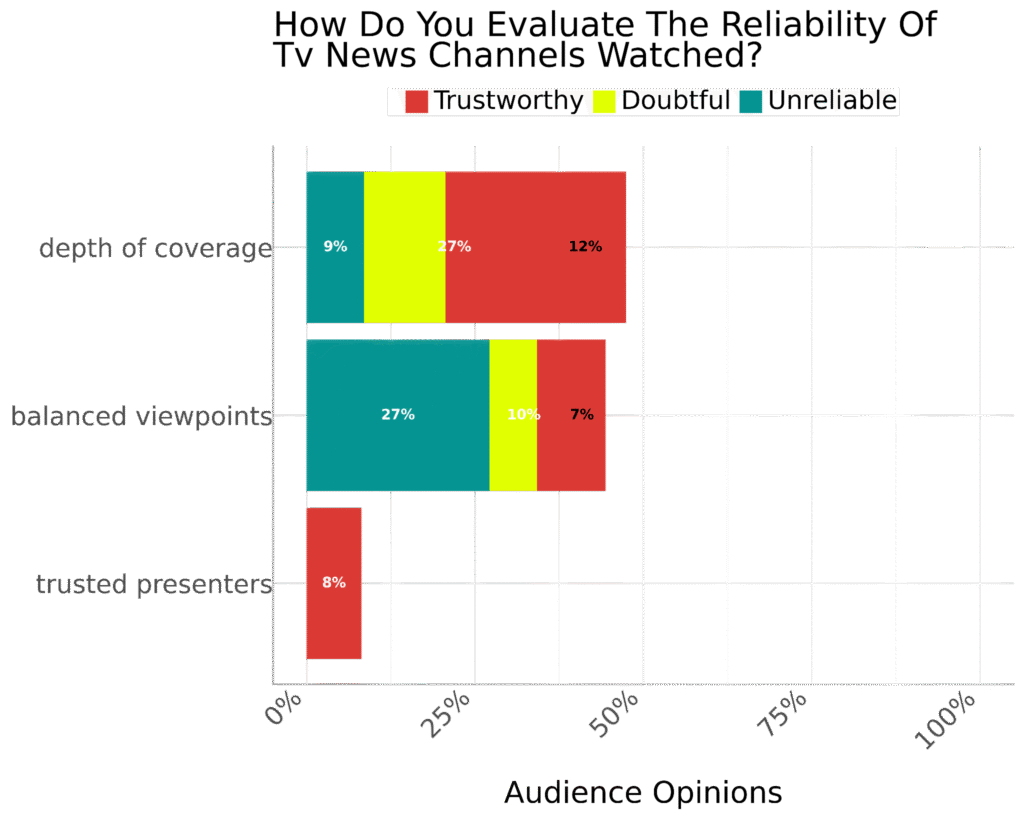

Given the generally low confidence in the media in the USA, it’s understandable that marketing leaders evaluate the reliability of the TV news channels they watch. How this is done varies from person to person. Among those who mentioned depth of coverage as an indicator of reliability, 9% thought this was unreliable, and 27% said this was doubtful, although 12% found this approach trustworthy.

Opinions were almost as strong regarding balanced viewpoints. According to 27%, this was unreliable, while 10% described it as unreliable. 7% thought this was an indicator of reliability. 8% of US marketers said they rated the reliability of tech TV news channels based on the channels’ use of trusted presenters.

The small proportion of our audience who use trusted presenters as an indicator of channel reliability aligns with the Edelman Trust Barometer. While the media is broadly distrusted, individuals might trust specific journalists, anchors, or brands, rather than having a general trust in the media.

Also, marketing leaders’ use of news channels to learn from competitors or review market shifts suggests that they prefer learning more about their customers or finding new customers through direct research, such as questionnaires, surveys, and focus groups.

Marketing leaders may also prefer to perform their own competitive analysis, rather than relying on channels whose reliability they struggle to assess. Conducting their own competitive analysis allows markets to consider factors such as market share, competitor strengths and weaknesses, opportunities for and potential barriers to market entry, target market importance to competitors, and secondary or indirect competitors.

Given the generally low confidence in the media in the USA, it’s understandable that marketing leaders evaluate the reliability of the TV news channels they watch. How this is done varies from person to person. Among those who mentioned depth of coverage as an indicator of reliability, 9% thought this was unreliable, and 27% said this was doubtful, although 12% found this approach trustworthy.

Opinions were almost as strong regarding balanced viewpoints. According to 27%, this was unreliable, while 10% described it as unreliable. 7% thought this was an indicator of reliability. 8% of US marketers said they rated the reliability of tech TV news channels based on the channels’ use of trusted presenters.

The small proportion of our audience who use trusted presenters as an indicator of channel reliability aligns with the Edelman Trust Barometer. While the media is broadly distrusted, individuals might trust specific journalists, anchors, or brands, rather than having a general trust in the media.

Also, marketing leaders’ use of news channels to learn from competitors or review market shifts suggests that they prefer learning more about their customers or finding new customers through direct research, such as questionnaires, surveys, and focus groups.

Marketing leaders may also prefer to perform their own competitive analysis, rather than relying on channels whose reliability they struggle to assess. Conducting their own competitive analysis allows markets to consider factors such as market share, competitor strengths and weaknesses, opportunities for and potential barriers to market entry, target market importance to competitors, and secondary or indirect competitors.

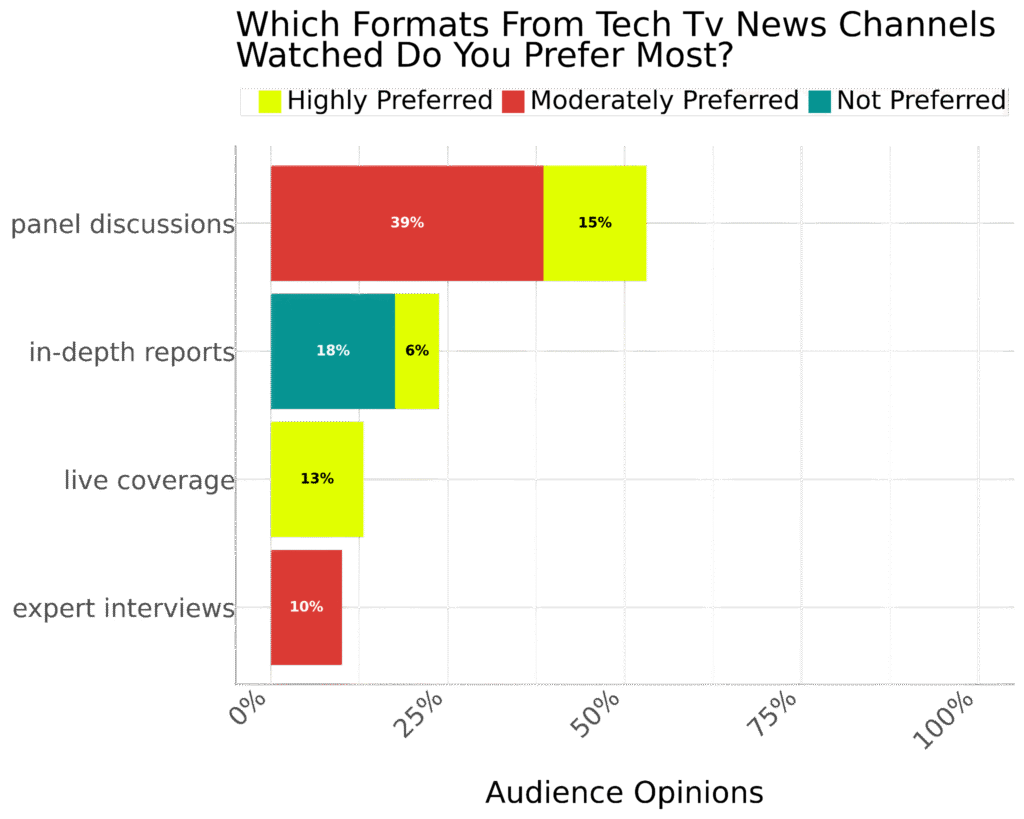

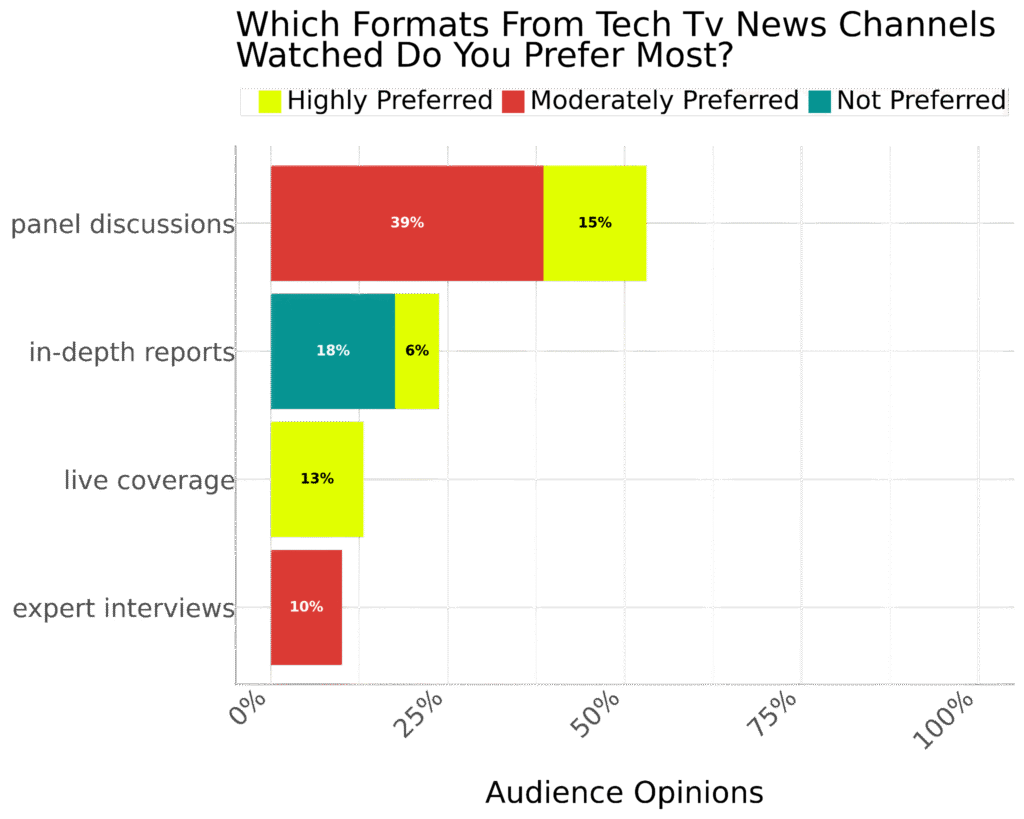

Rather than preferring one specific tech TV news channel format, our audience indicated a range of preferences.

The most popular of these were panel discussions, with preferences for this format being either moderate (39%) or high (15%). In-depth reports were the next format most widely mentioned among our audience, with 18% not preferring this, compared to 6% who highly preferred this format. The 13% who mentioned live coverage said they preferred it highly, while 10% said they had a moderate preference for expert interviews.

In a 2025 article, the Pew Research Center said its qualitative research indicated people’s approach to news has changed, with the general preference being for information without opinions or commentary. This may be the reason for our audience’s strong preferences for panel discussions, in-depth reports, and live coverage.

Rather than preferring one specific tech TV news channel format, our audience indicated a range of preferences.

The most popular of these were panel discussions, with preferences for this format being either moderate (39%) or high (15%). In-depth reports were the next format most widely mentioned among our audience, with 18% not preferring this, compared to 6% who highly preferred this format. The 13% who mentioned live coverage said they preferred it highly, while 10% said they had a moderate preference for expert interviews.

In a 2025 article, the Pew Research Center said its qualitative research indicated people’s approach to news has changed, with the general preference being for information without opinions or commentary. This may be the reason for our audience’s strong preferences for panel discussions, in-depth reports, and live coverage.

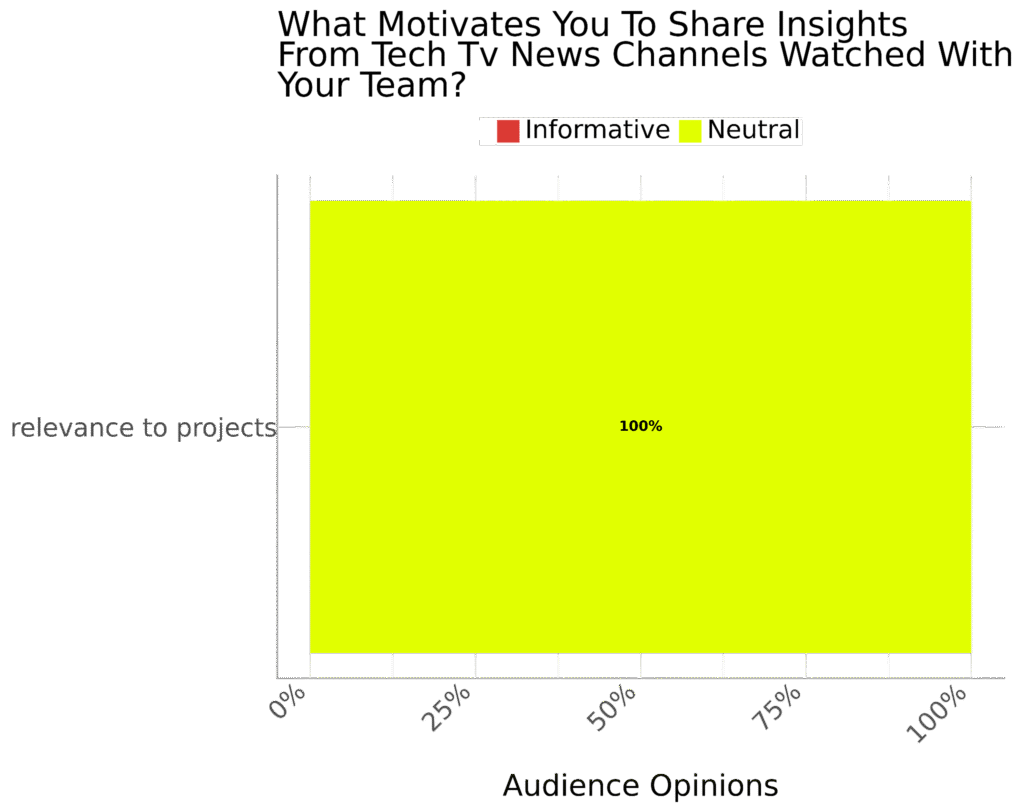

Project relevance was the single motivating factor for our audience sharing tech TV news channel insights with their teams. However, 100% said they were neutral about doing so. Again, this may be due to low trust in mass media. A 2024 Gallup poll found that trust in mass media sits at 31%, suggesting our audience shares selectively from specific channels, outlets, or anchors.

It’s also possible that marketing leaders’ motivation for watching TV news is not strongly connected to their work. This would be in keeping with the American Press Institute and Associated Press-NORC Center for Public Affairs Research’s Media Insight Project. The project found that the main motivation among 16 to 40-year-olds for watching news is to stay informed, feel connected, and be able to discuss topics with friends or family, rather than for educational or work purposes.

Project relevance was the single motivating factor for our audience sharing tech TV news channel insights with their teams. However, 100% said they were neutral about doing so. Again, this may be due to low trust in mass media. A 2024 Gallup poll found that trust in mass media sits at 31%, suggesting our audience shares selectively from specific channels, outlets, or anchors.

It’s also possible that marketing leaders’ motivation for watching TV news is not strongly connected to their work. This would be in keeping with the American Press Institute and Associated Press-NORC Center for Public Affairs Research’s Media Insight Project. The project found that the main motivation among 16 to 40-year-olds for watching news is to stay informed, feel connected, and be able to discuss topics with friends or family, rather than for educational or work purposes.

Although 100% of our audience said the TV news channels they watch influence their perception of global markets by emphasizing innovation, this was in neutral rather than informative ways.

One of the possible reasons for marketing leaders emphasizing neutrality in this regard is highlighted by a 2023 arXiv study, which revealed that broadcast news no longer encourages a sense of shared reality. Instead, the stories covered by cable network news channels and their framing of global issues are becoming increasingly divergent, leaving audiences with fragmented perceptions.

Although 100% of our audience said the TV news channels they watch influence their perception of global markets by emphasizing innovation, this was in neutral rather than informative ways.

One of the possible reasons for marketing leaders emphasizing neutrality in this regard is highlighted by a 2023 arXiv study, which revealed that broadcast news no longer encourages a sense of shared reality. Instead, the stories covered by cable network news channels and their framing of global issues are becoming increasingly divergent, leaving audiences with fragmented perceptions.

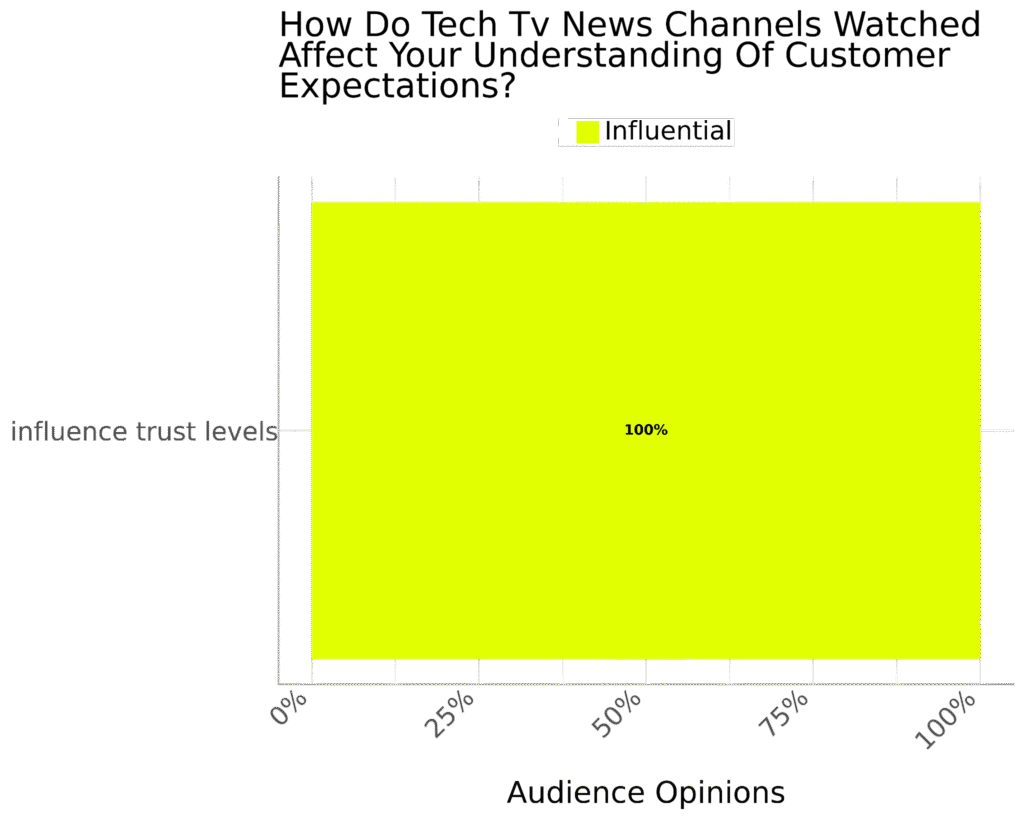

Our audience was unanimous when discussing how the tech TV news channels they watch affect their understanding of customer expectations. 100% of marketing leaders said the channels influence trust levels, suggesting that TV news still influences trust between brands and customers, even if neither has particularly strong faith in the media.

Despite our audience’s unanimity, there’s no indication of how much TV news influences trust. There’s a good chance the level of influence may be much lower than that of social media.

An older study published in the Journal of Service Research highlights how, in the past, customers were passive receivers of companies’ marketing efforts. Social media has changed this by turning marketing and brand relations into a conversation between brands and customers, allowing consumers to play a more active role and for both parties to base their trust on interactions rather than TV news.

Our audience was unanimous when discussing how the tech TV news channels they watch affect their understanding of customer expectations. 100% of marketing leaders said the channels influence trust levels, suggesting that TV news still influences trust between brands and customers, even if neither has particularly strong faith in the media.

Despite our audience’s unanimity, there’s no indication of how much TV news influences trust. There’s a good chance the level of influence may be much lower than that of social media.

An older study published in the Journal of Service Research highlights how, in the past, customers were passive receivers of companies’ marketing efforts. Social media has changed this by turning marketing and brand relations into a conversation between brands and customers, allowing consumers to play a more active role and for both parties to base their trust on interactions rather than TV news.

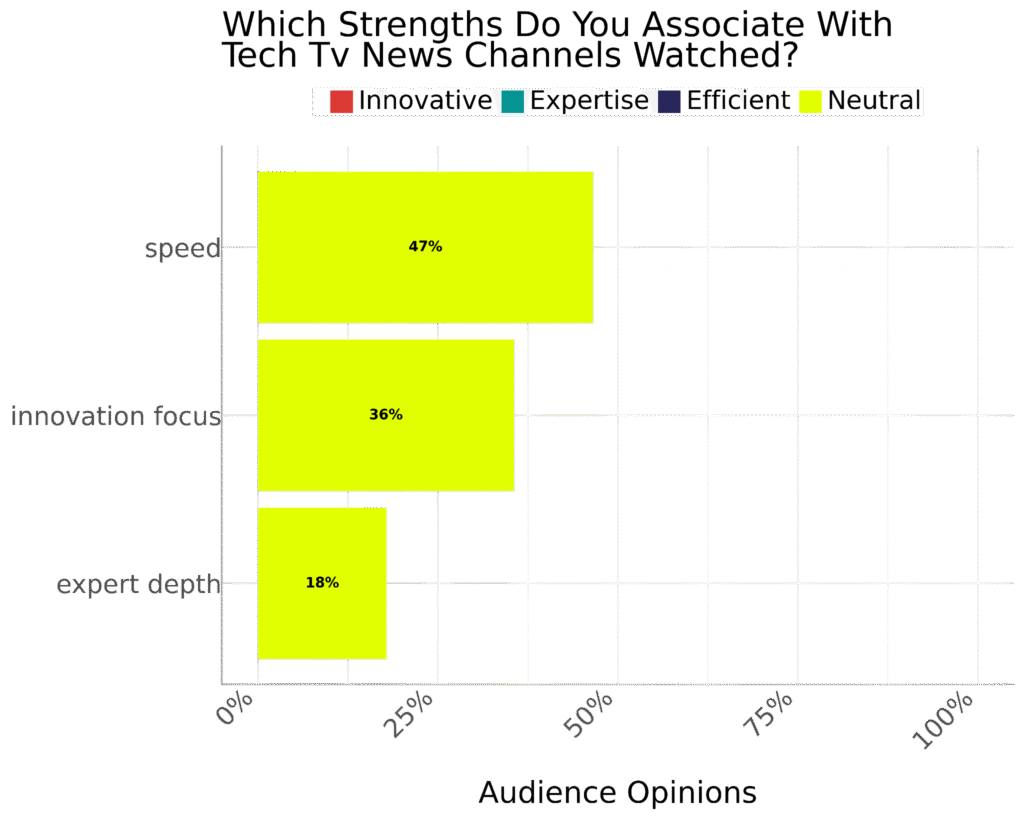

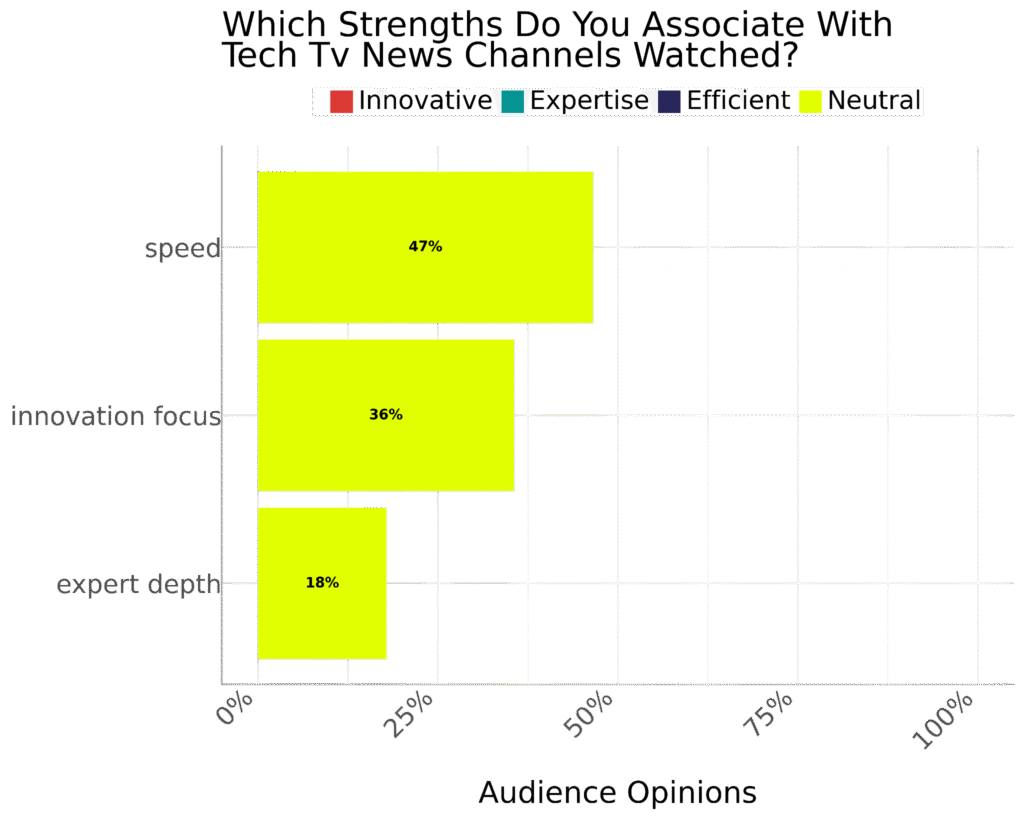

American marketing leaders had different opinions regarding the strengths they associate with the tech TV news channels they watch, although all opinions were neutral.

Almost half (47%) of our audience said they associated speed with their preferred channels. This finding is in keeping with a 2025 NewscastStudio article on trends defining broadcast and media in 2025. One of the major trends identified was accelerated content creation in response to growing demands for more content across platforms, even though it acknowledges that live sports and news are exempt from this trend due to their unique production and delivery requirements.

The rest of our audience mentioned innovation focus (36%) and expert depth (18%) as strengths. This suggests that while speed remains the most valued trait, a significant portion of viewers still look for channels that balance fast reporting with forward-thinking approaches and in-depth expertise.

American marketing leaders had different opinions regarding the strengths they associate with the tech TV news channels they watch, although all opinions were neutral.

Almost half (47%) of our audience said they associated speed with their preferred channels. This finding is in keeping with a 2025 NewscastStudio article on trends defining broadcast and media in 2025. One of the major trends identified was accelerated content creation in response to growing demands for more content across platforms, even though it acknowledges that live sports and news are exempt from this trend due to their unique production and delivery requirements.

The rest of our audience mentioned innovation focus (36%) and expert depth (18%) as strengths. This suggests that while speed remains the most valued trait, a significant portion of viewers still look for channels that balance fast reporting with forward-thinking approaches and in-depth expertise.

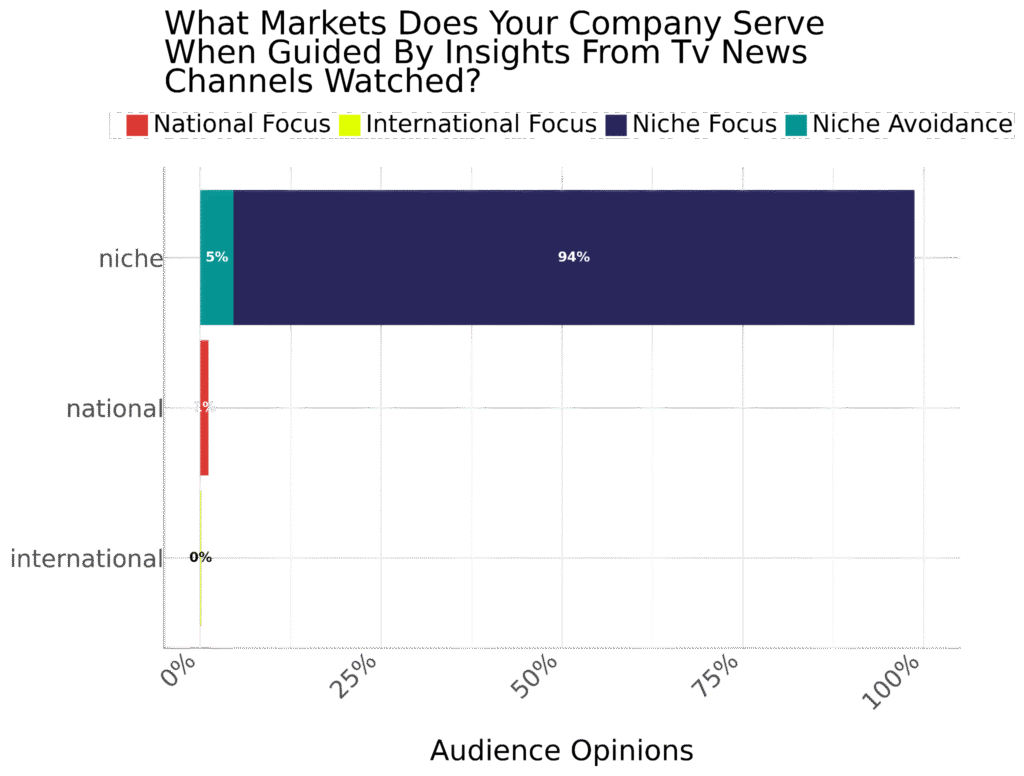

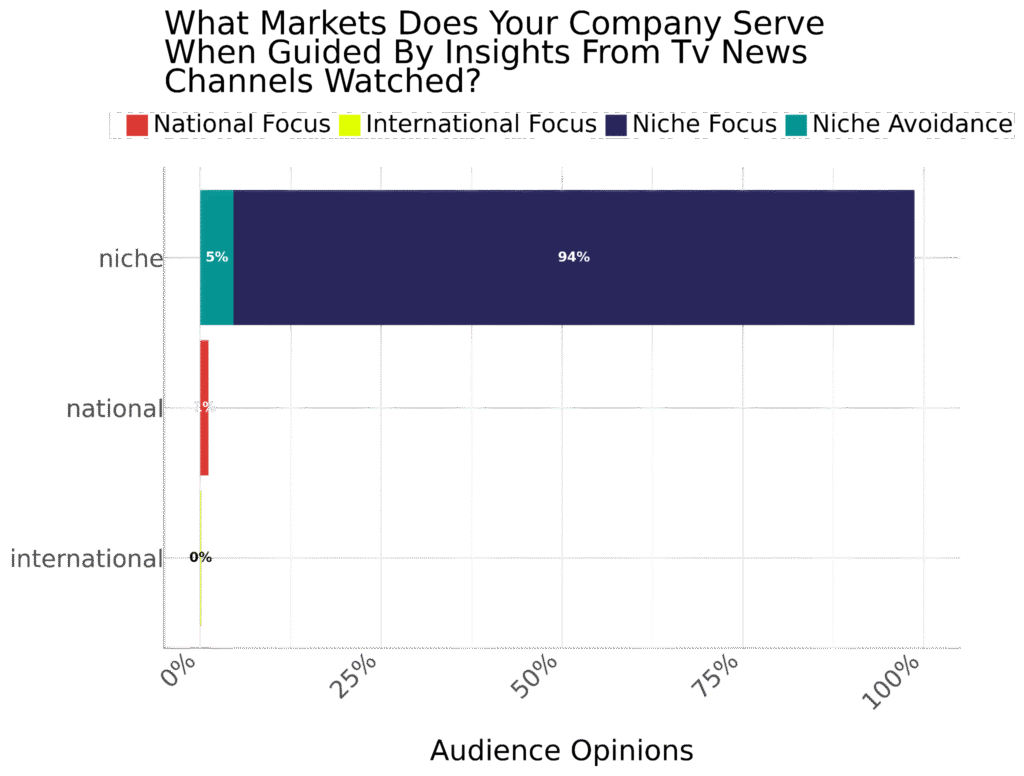

When discussing which markets their companies serve, when guided by insights from the tech TV news channels they watch, the overwhelming majority (94%) of marketing leaders said they served a niche focus market. This indicates that marketers are aware of the significant potential of niche markets.

Recent research from Accenture found that, in the last five years, venture capital investments in startups in eight countries grew by 36% to reach $361 billion. This growth rate is comparable to that of the US, which saw venture capital investments grow by 30% in the same period. More than half of these investments were directed at various markets propelled by technology.

Among those who did not share the majority’s view were 5% who said their companies served a niche avoidance market, while 1% said their companies served a national focus market. This stark disparity in numbers shows where the real focus lies.

When discussing which markets their companies serve, when guided by insights from the tech TV news channels they watch, the overwhelming majority (94%) of marketing leaders said they served a niche focus market. This indicates that marketers are aware of the significant potential of niche markets.

Recent research from Accenture found that, in the last five years, venture capital investments in startups in eight countries grew by 36% to reach $361 billion. This growth rate is comparable to that of the US, which saw venture capital investments grow by 30% in the same period. More than half of these investments were directed at various markets propelled by technology.

Among those who did not share the majority’s view were 5% who said their companies served a niche avoidance market, while 1% said their companies served a national focus market. This stark disparity in numbers shows where the real focus lies.

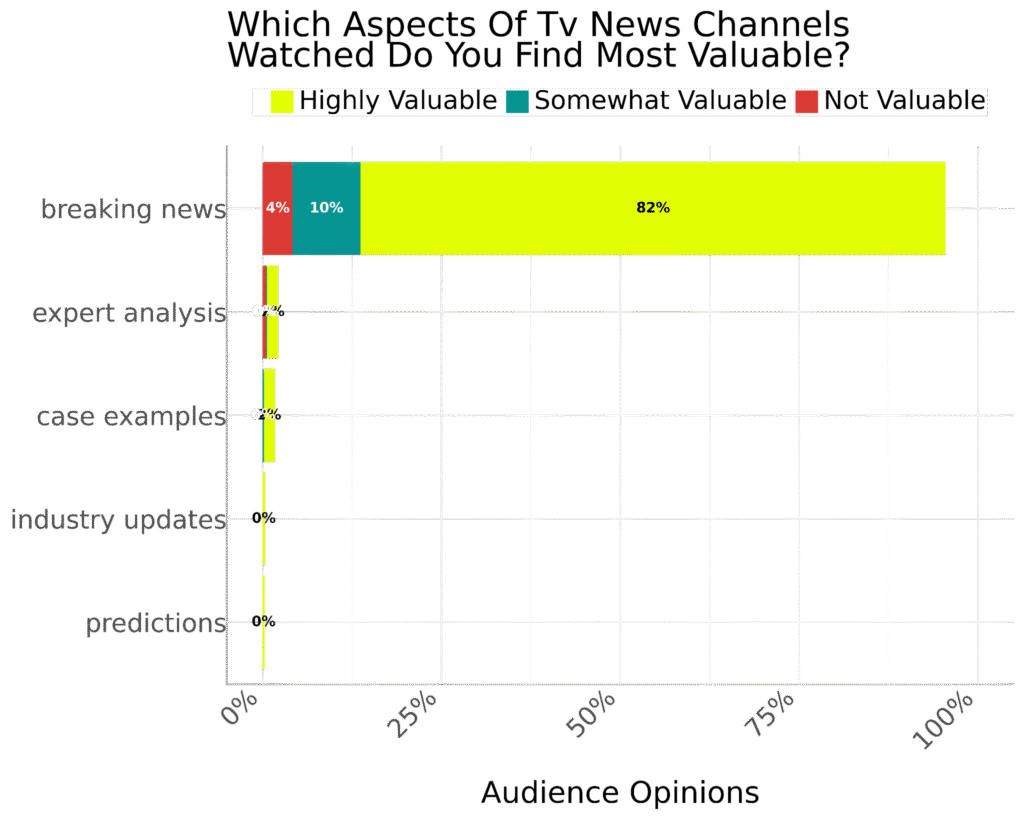

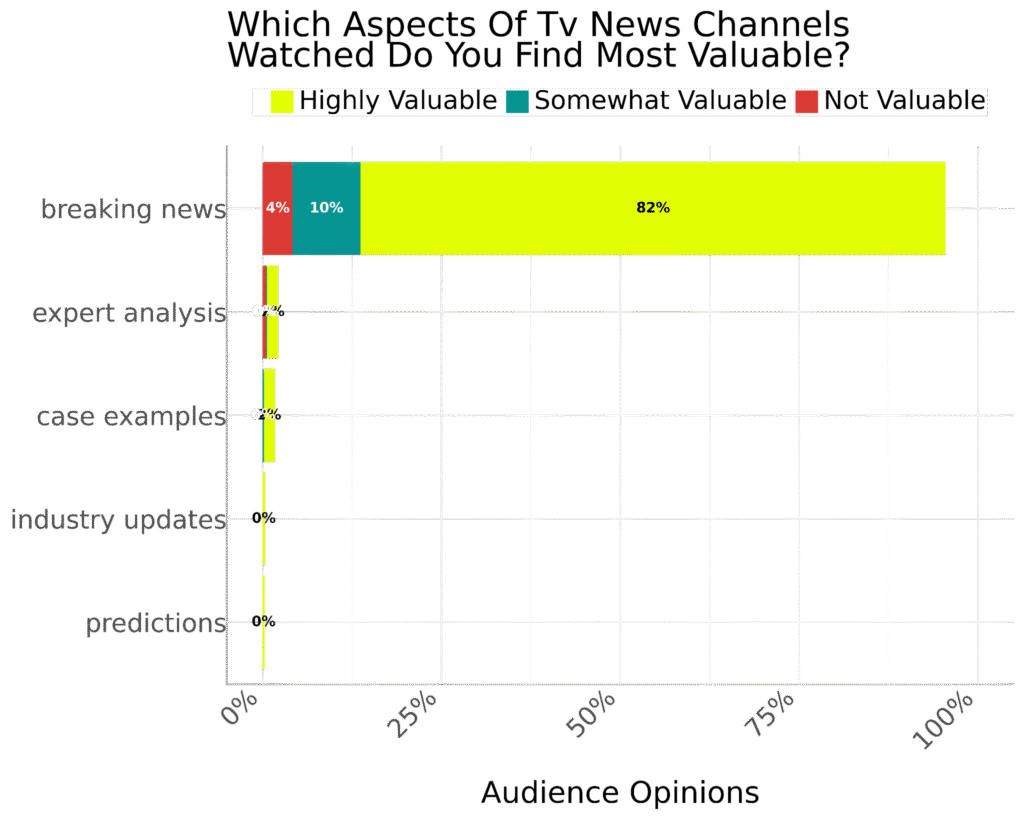

Our audience made it clear that there’s an overwhelming preference for breaking news, with 82% considering this a highly valuable aspect of the TV news channels they watch. In contrast, only 10% said breaking news was somewhat valuable, while 4% said it wasn’t valuable.

Other aspects considered highly valuable scored very low, with both expert analysis and case examples only garnering 2% of opinions each. No one mentioned industry updates or predictions.

A study published in the Electronics journal found that breaking news, especially when sensationalized, attracts online users’ attention while reducing the credibility of the content and of the channel or platform sharing it. This may be one of the reasons why some in our audience did not think breaking news was valuable or preferred other aspects of the news channels they watch.

Our audience made it clear that there’s an overwhelming preference for breaking news, with 82% considering this a highly valuable aspect of the TV news channels they watch. In contrast, only 10% said breaking news was somewhat valuable, while 4% said it wasn’t valuable.

Other aspects considered highly valuable scored very low, with both expert analysis and case examples only garnering 2% of opinions each. No one mentioned industry updates or predictions.

A study published in the Electronics journal found that breaking news, especially when sensationalized, attracts online users’ attention while reducing the credibility of the content and of the channel or platform sharing it. This may be one of the reasons why some in our audience did not think breaking news was valuable or preferred other aspects of the news channels they watch.

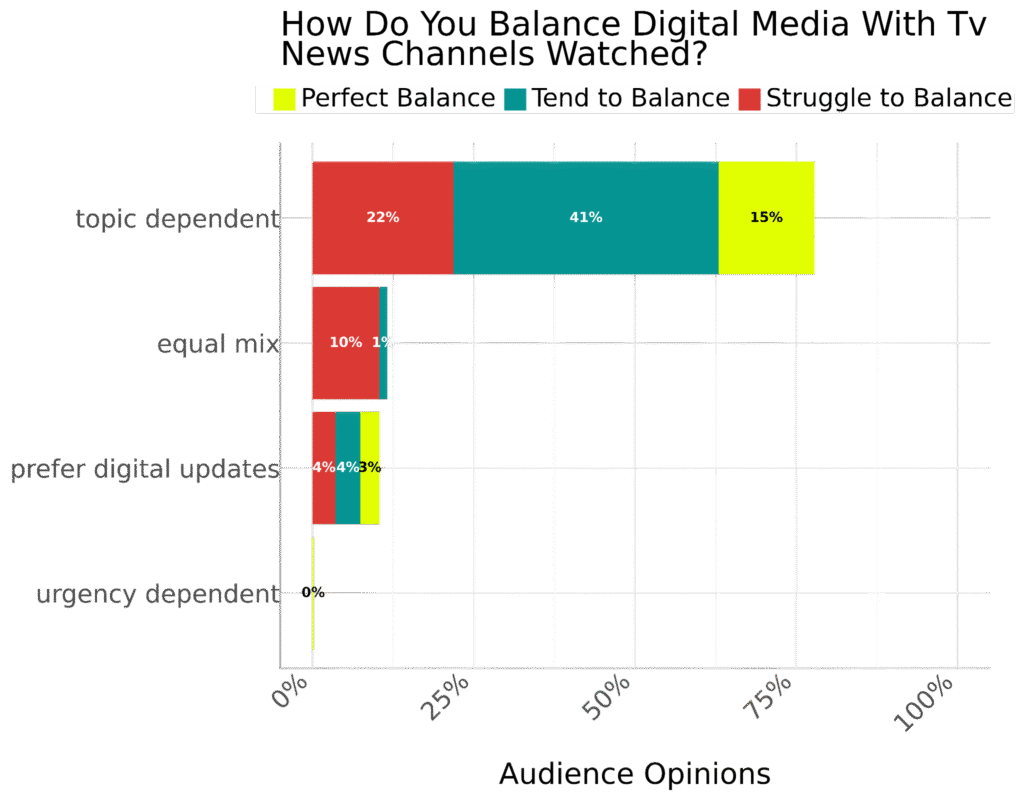

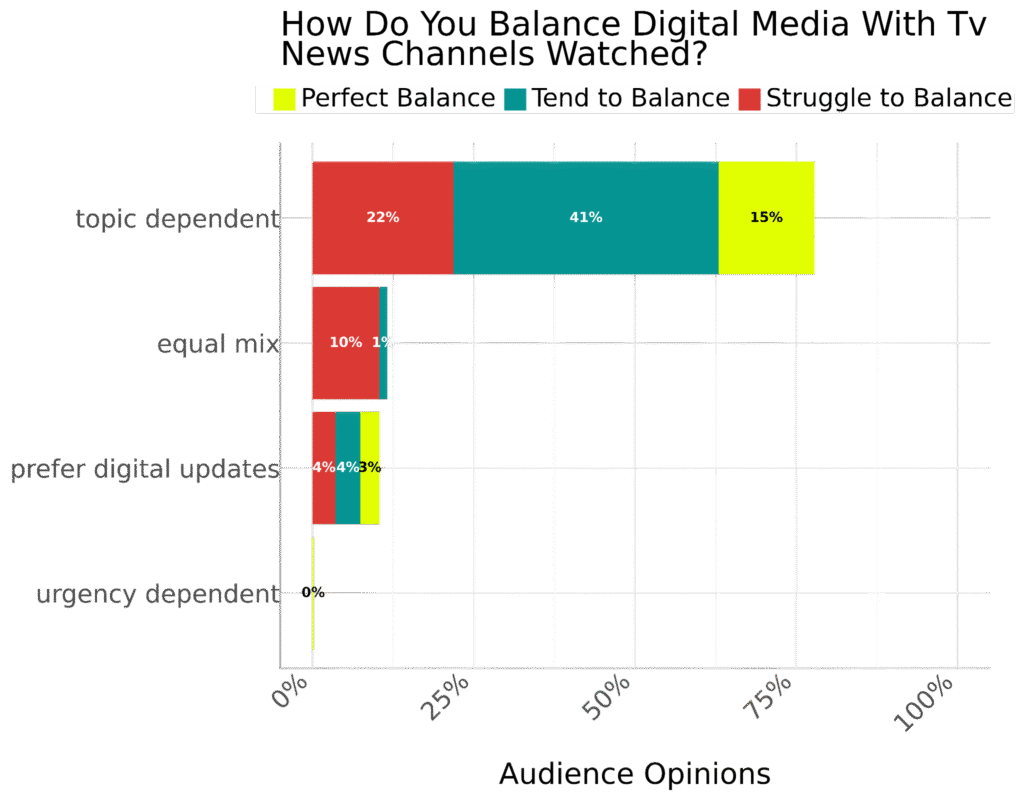

Based on marketing leaders’ opinions, it’s clear that there are rather different approaches to balancing digital media with preferred tech TV news channels. 41% of our audience tends to balance digital media with TV news according to topic, while 15% said they find a perfect balance this way. 22% said they struggled to balance the two according to topic.

Among those who mentioned using an equal mix of digital media and TV news, 10% said they struggled to find a balance, while just 1% said they tended to find a balance by doing this.

Some in our audience expressed a preference for digital updates. Among these, 4% said they struggled to find a balance, while another 4% said they tended to find a balance, thanks to these updates. 3% said they found digital updates provided a perfect balance to TV news.

Interestingly, the 2025 Reuters Institute for the Study of Journalism Digital News Report revealed that social media has replaced TV as the main way Americans access news. According to the report, 54% of Americans access news via social media and video networks, compared to 50% who rely on TV news and 48% who turn to news websites or apps.

Based on marketing leaders’ opinions, it’s clear that there are rather different approaches to balancing digital media with preferred tech TV news channels. 41% of our audience tends to balance digital media with TV news according to topic, while 15% said they find a perfect balance this way. 22% said they struggled to balance the two according to topic.

Among those who mentioned using an equal mix of digital media and TV news, 10% said they struggled to find a balance, while just 1% said they tended to find a balance by doing this.

Some in our audience expressed a preference for digital updates. Among these, 4% said they struggled to find a balance, while another 4% said they tended to find a balance, thanks to these updates. 3% said they found digital updates provided a perfect balance to TV news.

Interestingly, the 2025 Reuters Institute for the Study of Journalism Digital News Report revealed that social media has replaced TV as the main way Americans access news. According to the report, 54% of Americans access news via social media and video networks, compared to 50% who rely on TV news and 48% who turn to news websites or apps.

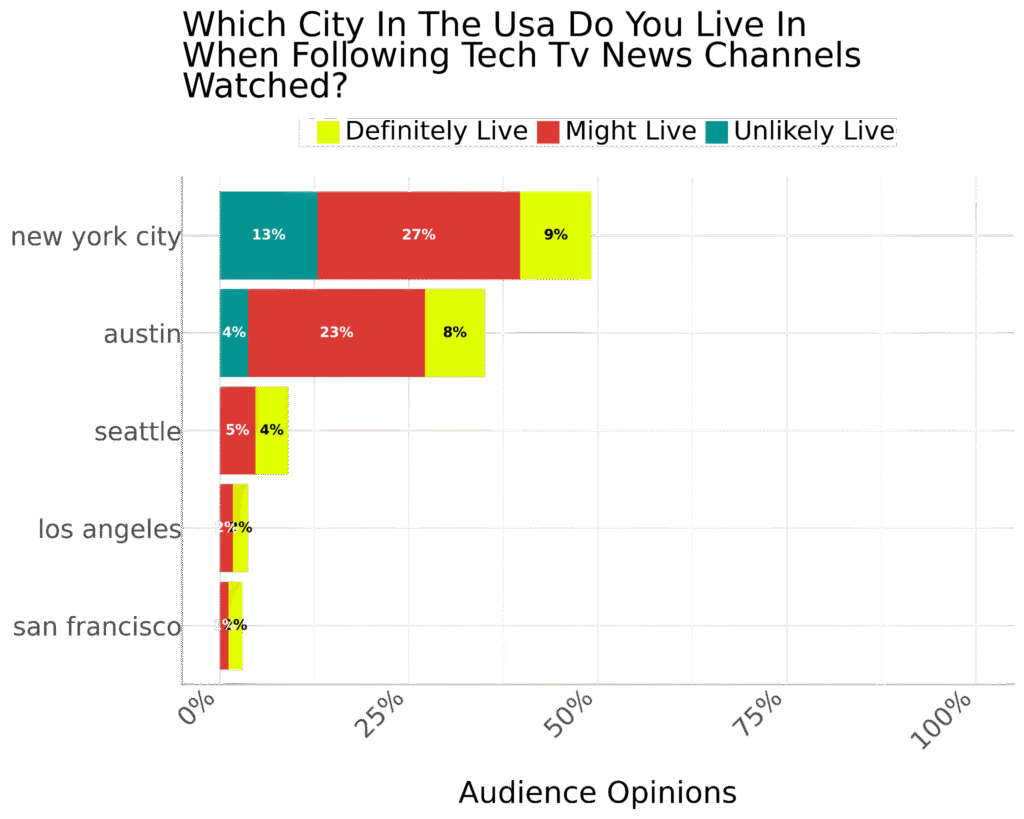

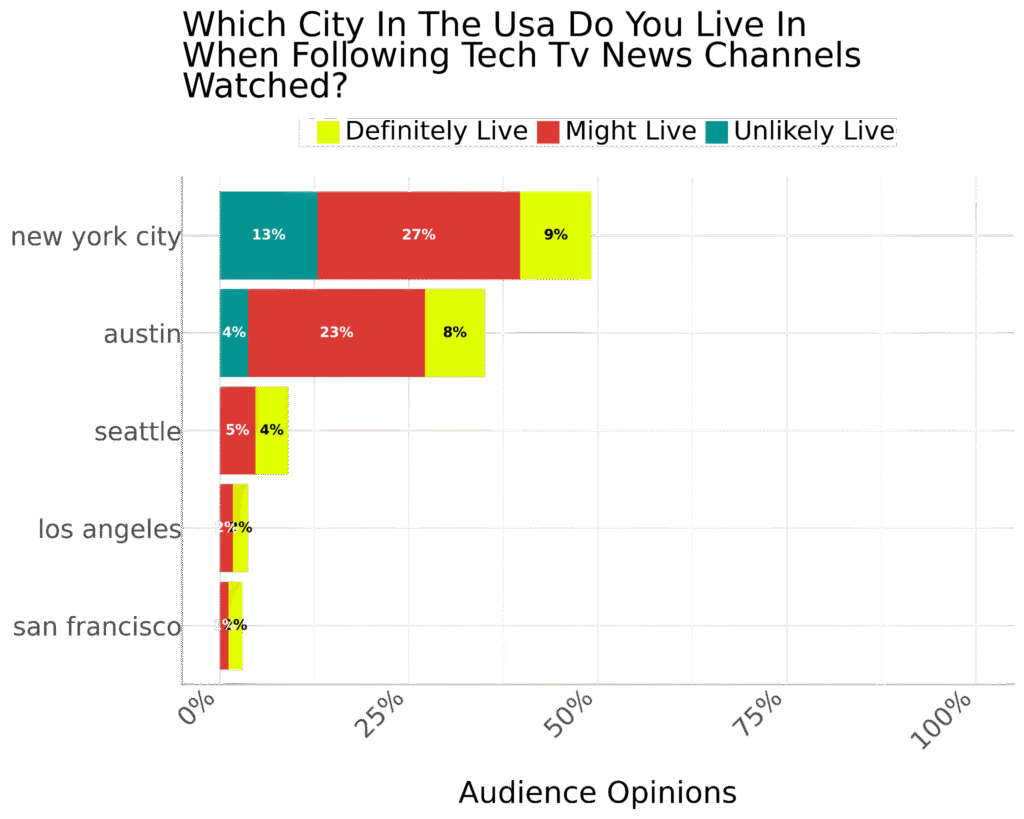

In our audience, 27% might live in the Big Apple, 13% are unlikely to live there, and 9% definitely live there. 4% were unlikely to live in Austin, while 23% might live there, and 8% definitely live in the Texan city. Of those who mentioned Seattle, 5% might live in the city, compared to 4% who are definite residents.

Those who mentioned Los Angeles either might (2%) or definitely (2%) live in the City of Angels, while 1% of those who named San Francisco might live there, compared to 2% who definitely live in the Golden City. This shows a majority in NY, which is considered the world’s biggest business hub, with a smaller presence in other major cities across the US.

In our audience, 27% might live in the Big Apple, 13% are unlikely to live there, and 9% definitely live there. 4% were unlikely to live in Austin, while 23% might live there, and 8% definitely live in the Texan city. Of those who mentioned Seattle, 5% might live in the city, compared to 4% who are definite residents.

Those who mentioned Los Angeles either might (2%) or definitely (2%) live in the City of Angels, while 1% of those who named San Francisco might live there, compared to 2% who definitely live in the Golden City. This shows a majority in NY, which is considered the world’s biggest business hub, with a smaller presence in other major cities across the US.

Index

- 21% of US marketing leaders frequently rely on weekly tech TV news channels for industry-related updates

- 28% of marketing leaders support cautious adoption of new trends seen on tech TV news channels

- Audience targeting on tech TV has a neutral influence on 91% of marketing leaders’ external communication strategies

- CNBC is rated the most reliable, credible TV news channel by 17% of marketing leaders

- 54% of marketing leaders find that tech TV channels are informative for learning from competitor strategies

- 27% of marketing leaders find balanced viewpoints to be unreliable when evaluating the reliability of TV news channels

- 39% of our audience has a moderate preference for panel discussion formats

- Project relevance motivates 100% of our audience to share tech TV new channel insights

- 100% of marketing leaders are neutral regarding TV news channels emphasizing innovation

- 100% of marketing leaders say tech TV news channels influence trust levels

- 47% of marketing leaders are neutral about associating speed with the tech TV news channels they watch

- 94% of marketing leaders’ companies serve a niche focus market when guided by TV news channel insights

- 82% of marketing leaders find breaking news highly valuable

- 41% of marketing leaders tend to balance digital media with TV, according to the topic

- 27% of US marketing leaders might live in New York City when watching TV tech news channels

- Digital Sources Overtaking Traditional Channels

- Methodology

How Often Do You Rely On Tech TV News Channels For Industry Updates?

21% of US marketing leaders frequently rely on weekly tech TV news channels for industry-related updates There is a wide range of habits amongst those watching TV news channels for updates: Fewer than a quarter of marketing leaders in our audience said that they regularly watch tech TV news channels for industry updates. Among those who indicated an occasional reliance on TV news updates, 21% said they watched monthly, while another 21% said they watched occasionally. Some indicated frequent reliance on this medium, relying on it frequently every week, while 19% said they watched tech TV news for daily updates. Another 19% said they rarely relied on this medium.

These insights are more or less in line with a 2025 Deloitte survey, which found Americans spend an average of six hours with media and entertainment content daily. However, the type of content and the activities performed during this time vary by generation. While Boomers spend 1.4 hours watching TV shows or movies on streaming video services and 2.1 hours watching TV shows or movies on cable or live-streaming TV services, Millennials spend 1.5 hours and 0.9 hours on the same activities.

This suggests the majority of marketing leaders generally turn to other sources for industry updates, while those who rely on tech TV news channels may be influenced by the behavior of their peers.

Fewer than a quarter of marketing leaders in our audience said that they regularly watch tech TV news channels for industry updates. Among those who indicated an occasional reliance on TV news updates, 21% said they watched monthly, while another 21% said they watched occasionally. Some indicated frequent reliance on this medium, relying on it frequently every week, while 19% said they watched tech TV news for daily updates. Another 19% said they rarely relied on this medium.

These insights are more or less in line with a 2025 Deloitte survey, which found Americans spend an average of six hours with media and entertainment content daily. However, the type of content and the activities performed during this time vary by generation. While Boomers spend 1.4 hours watching TV shows or movies on streaming video services and 2.1 hours watching TV shows or movies on cable or live-streaming TV services, Millennials spend 1.5 hours and 0.9 hours on the same activities.

This suggests the majority of marketing leaders generally turn to other sources for industry updates, while those who rely on tech TV news channels may be influenced by the behavior of their peers.

What Role Do Tech TV News Channels Play In Shaping Your Perception Of New Technology Trends?

28% of marketing leaders support cautious adoption of new trends seen on tech TV news channels Tech TV news channels shape perceptions of new technology trends in various ways: There are a variety of perspectives regarding the role of tech TV news channels in shaping American marketing leaders’ perceptions of new technology trends. At 28%, the largest proportion of our audience said news channels encouraged them to support cautious adoption of new trends or technologies.

However, 7% had neutral feelings about TV news driving early adoption, while 22% said TV news supportively drove early adoption. 16% were cautious about TV news media encouraging pilot testing, and another 16% shared this feeling about news channels’ highlighting of risks. 11% said tech TV news channels were supportive in providing reassurance.

These findings may reflect the growing disinterest in news overall, as revealed in the 2024 Reuters Institute for the Study of Journalism Digital News Report. According to the report, only 46% of respondents said they were either extremely or very interested in news, marking a 27% decline since 2016.

The general lack of interest in news has potentially serious ramifications for societies, such as a potential decline in democratic engagement, which requires political interest and knowledge, and not being able to identify or counter misinformation.

In the context of marketing leaders and their work, a disinterest in news could have similar consequences, namely losing track of what’s happening in their industries and in the wider business world, and falling victim to misinformation, which could result in potentially disastrous business decisions.

There are a variety of perspectives regarding the role of tech TV news channels in shaping American marketing leaders’ perceptions of new technology trends. At 28%, the largest proportion of our audience said news channels encouraged them to support cautious adoption of new trends or technologies.

However, 7% had neutral feelings about TV news driving early adoption, while 22% said TV news supportively drove early adoption. 16% were cautious about TV news media encouraging pilot testing, and another 16% shared this feeling about news channels’ highlighting of risks. 11% said tech TV news channels were supportive in providing reassurance.

These findings may reflect the growing disinterest in news overall, as revealed in the 2024 Reuters Institute for the Study of Journalism Digital News Report. According to the report, only 46% of respondents said they were either extremely or very interested in news, marking a 27% decline since 2016.

The general lack of interest in news has potentially serious ramifications for societies, such as a potential decline in democratic engagement, which requires political interest and knowledge, and not being able to identify or counter misinformation.

In the context of marketing leaders and their work, a disinterest in news could have similar consequences, namely losing track of what’s happening in their industries and in the wider business world, and falling victim to misinformation, which could result in potentially disastrous business decisions.

How Do Tech TV News Channels Influence Your Company’s External Communication Strategy?

Audience targeting on tech TV has a neutral influence on 91% of marketing leaders’ external communication strategies External communication strategies are influenced in different ways by TV news channels: Our audience of US marketing leaders remained neutral regarding TV news channels’ influence on their companies’ external communication strategies, whether discussing audience targeting (91%), market positioning (9%), or campaign timing (1%). This suggests companies’ external communication strategies place greater focus on other channels, such as email or social media.

That our audience’s companies possibly focus on other communication platforms aligns with the findings and recommendations contained in a 2024 article published in the Educational Administration Theory and Practice journal. Acknowledging the many different communication channels available today, the article emphasizes that choosing the appropriate channel is essential if organizations want to communicate effectively.

Our audience of US marketing leaders remained neutral regarding TV news channels’ influence on their companies’ external communication strategies, whether discussing audience targeting (91%), market positioning (9%), or campaign timing (1%). This suggests companies’ external communication strategies place greater focus on other channels, such as email or social media.

That our audience’s companies possibly focus on other communication platforms aligns with the findings and recommendations contained in a 2024 article published in the Educational Administration Theory and Practice journal. Acknowledging the many different communication channels available today, the article emphasizes that choosing the appropriate channel is essential if organizations want to communicate effectively.

Which TV News Channels Do You Consider The Most Credible?

CNBC is rated the most reliable, credible TV news channel by 17% of marketing leaders Opinions differ on which TV news channels are the most credible: The varied opinions regarding which TV news channels US marketing leaders think are the most credible suggest our audience understands that not all channels are created equal. They were most vocal about CNBC, with 17% rating it as the most reliable, while 3% regarded it as the most credible. However, their appreciation was not shared by all, as 22% said CNBC was questionable, while 16% said the channel was not credible.

Among those who mentioned Fox Business, 5% said they thought it was reliable, but only 1% described it as credible. However, there was a greater number of opinions not in favor of this channel, with 10% saying it was questionable and 6% saying it wasn’t credible.

Bloomberg fared marginally better, with 1% saying it was credible and 6% describing it as reliable, while 2% said it wasn’t credible and 3% said the channel was questionable. CNN was the least regarded of the TV news channels mentioned, with no one saying it was credible. Instead, 3% said the channel wasn’t credible, 5% said it was questionable, and 1% said it was reliable.

Taking these diverse opinions into account, CNBC emerges as the most credible and reliable of TV news channels.

These insights tie in with what we mentioned above about the growing lack of trust in the media and disinterest in news, suggesting that marketing leaders are aware of potential negative biases or misinformation spread by some TV news channels.

Interestingly, a 2024 YouGov survey revealed that the most trusted news sources in America include The Weather Channel, BBC, PBS, The Wall Street Journal, and Forbes. CNBC (+2) ranked lower than Bloomberg (+7) and the same as CNN (+2). Fox Business (-2) was one of the least trusted.

The varied opinions regarding which TV news channels US marketing leaders think are the most credible suggest our audience understands that not all channels are created equal. They were most vocal about CNBC, with 17% rating it as the most reliable, while 3% regarded it as the most credible. However, their appreciation was not shared by all, as 22% said CNBC was questionable, while 16% said the channel was not credible.

Among those who mentioned Fox Business, 5% said they thought it was reliable, but only 1% described it as credible. However, there was a greater number of opinions not in favor of this channel, with 10% saying it was questionable and 6% saying it wasn’t credible.

Bloomberg fared marginally better, with 1% saying it was credible and 6% describing it as reliable, while 2% said it wasn’t credible and 3% said the channel was questionable. CNN was the least regarded of the TV news channels mentioned, with no one saying it was credible. Instead, 3% said the channel wasn’t credible, 5% said it was questionable, and 1% said it was reliable.

Taking these diverse opinions into account, CNBC emerges as the most credible and reliable of TV news channels.

These insights tie in with what we mentioned above about the growing lack of trust in the media and disinterest in news, suggesting that marketing leaders are aware of potential negative biases or misinformation spread by some TV news channels.

Interestingly, a 2024 YouGov survey revealed that the most trusted news sources in America include The Weather Channel, BBC, PBS, The Wall Street Journal, and Forbes. CNBC (+2) ranked lower than Bloomberg (+7) and the same as CNN (+2). Fox Business (-2) was one of the least trusted.

How Do Tech TV News Channels Help You Track Competitors?

54% of marketing leaders find that tech TV channels are informative for learning from competitor strategies There are two main ways in which tech TV news channels help marketing leaders track competitors: While some marketing leaders in the US don’t place much faith in tech TV news channels for industry updates or shaping communication strategies, they still find these platforms helpful. One of the ways in which news channels help our audience is in tracking competitors, although how this happens varies. 54% of our audience said they find news channels informative when learning from competitors’ strategies. For 46%, channels are informative sources of information when reviewing market shifts.

That slightly more than half of our audience uses tech TV news channels to learn from competitors’ strategies isn’t surprising. This may have been a popular approach in the past, but social media is now the preferred method of monitoring competitors.

According to Sprout Social, 90% of marketers agree that social data enables them to gain an advantage over their competitors, while 86% said they identify new business opportunities by using competitor insights from social media.

While some marketing leaders in the US don’t place much faith in tech TV news channels for industry updates or shaping communication strategies, they still find these platforms helpful. One of the ways in which news channels help our audience is in tracking competitors, although how this happens varies. 54% of our audience said they find news channels informative when learning from competitors’ strategies. For 46%, channels are informative sources of information when reviewing market shifts.

That slightly more than half of our audience uses tech TV news channels to learn from competitors’ strategies isn’t surprising. This may have been a popular approach in the past, but social media is now the preferred method of monitoring competitors.

According to Sprout Social, 90% of marketers agree that social data enables them to gain an advantage over their competitors, while 86% said they identify new business opportunities by using competitor insights from social media.

How Do You Evaluate The Reliability Of TV News Channels?

27% of marketing leaders find balanced viewpoints to be unreliable when evaluating the reliability of TV news channels Various criteria are used to evaluate the reliability of the TV news channels: Given the generally low confidence in the media in the USA, it’s understandable that marketing leaders evaluate the reliability of the TV news channels they watch. How this is done varies from person to person. Among those who mentioned depth of coverage as an indicator of reliability, 9% thought this was unreliable, and 27% said this was doubtful, although 12% found this approach trustworthy.

Opinions were almost as strong regarding balanced viewpoints. According to 27%, this was unreliable, while 10% described it as unreliable. 7% thought this was an indicator of reliability. 8% of US marketers said they rated the reliability of tech TV news channels based on the channels’ use of trusted presenters.

The small proportion of our audience who use trusted presenters as an indicator of channel reliability aligns with the Edelman Trust Barometer. While the media is broadly distrusted, individuals might trust specific journalists, anchors, or brands, rather than having a general trust in the media.

Also, marketing leaders’ use of news channels to learn from competitors or review market shifts suggests that they prefer learning more about their customers or finding new customers through direct research, such as questionnaires, surveys, and focus groups.

Marketing leaders may also prefer to perform their own competitive analysis, rather than relying on channels whose reliability they struggle to assess. Conducting their own competitive analysis allows markets to consider factors such as market share, competitor strengths and weaknesses, opportunities for and potential barriers to market entry, target market importance to competitors, and secondary or indirect competitors.

Given the generally low confidence in the media in the USA, it’s understandable that marketing leaders evaluate the reliability of the TV news channels they watch. How this is done varies from person to person. Among those who mentioned depth of coverage as an indicator of reliability, 9% thought this was unreliable, and 27% said this was doubtful, although 12% found this approach trustworthy.

Opinions were almost as strong regarding balanced viewpoints. According to 27%, this was unreliable, while 10% described it as unreliable. 7% thought this was an indicator of reliability. 8% of US marketers said they rated the reliability of tech TV news channels based on the channels’ use of trusted presenters.

The small proportion of our audience who use trusted presenters as an indicator of channel reliability aligns with the Edelman Trust Barometer. While the media is broadly distrusted, individuals might trust specific journalists, anchors, or brands, rather than having a general trust in the media.

Also, marketing leaders’ use of news channels to learn from competitors or review market shifts suggests that they prefer learning more about their customers or finding new customers through direct research, such as questionnaires, surveys, and focus groups.

Marketing leaders may also prefer to perform their own competitive analysis, rather than relying on channels whose reliability they struggle to assess. Conducting their own competitive analysis allows markets to consider factors such as market share, competitor strengths and weaknesses, opportunities for and potential barriers to market entry, target market importance to competitors, and secondary or indirect competitors.

Which Formats From Tech TV News Channels Do You Prefer Most?

39% of our audience has a moderate preference for panel discussion formats Marketing leaders have a range of preferences for tech TV news channel formats: Rather than preferring one specific tech TV news channel format, our audience indicated a range of preferences.

The most popular of these were panel discussions, with preferences for this format being either moderate (39%) or high (15%). In-depth reports were the next format most widely mentioned among our audience, with 18% not preferring this, compared to 6% who highly preferred this format. The 13% who mentioned live coverage said they preferred it highly, while 10% said they had a moderate preference for expert interviews.

In a 2025 article, the Pew Research Center said its qualitative research indicated people’s approach to news has changed, with the general preference being for information without opinions or commentary. This may be the reason for our audience’s strong preferences for panel discussions, in-depth reports, and live coverage.

Rather than preferring one specific tech TV news channel format, our audience indicated a range of preferences.

The most popular of these were panel discussions, with preferences for this format being either moderate (39%) or high (15%). In-depth reports were the next format most widely mentioned among our audience, with 18% not preferring this, compared to 6% who highly preferred this format. The 13% who mentioned live coverage said they preferred it highly, while 10% said they had a moderate preference for expert interviews.

In a 2025 article, the Pew Research Center said its qualitative research indicated people’s approach to news has changed, with the general preference being for information without opinions or commentary. This may be the reason for our audience’s strong preferences for panel discussions, in-depth reports, and live coverage.

What Motivates You To Share Insights From Tech TV News Channels With Your Team?

Project relevance motivates 100% of our audience to share tech TV new channel insights The motivation for sharing insights from tech TV news channels with teams is unanimous: Project relevance was the single motivating factor for our audience sharing tech TV news channel insights with their teams. However, 100% said they were neutral about doing so. Again, this may be due to low trust in mass media. A 2024 Gallup poll found that trust in mass media sits at 31%, suggesting our audience shares selectively from specific channels, outlets, or anchors.

It’s also possible that marketing leaders’ motivation for watching TV news is not strongly connected to their work. This would be in keeping with the American Press Institute and Associated Press-NORC Center for Public Affairs Research’s Media Insight Project. The project found that the main motivation among 16 to 40-year-olds for watching news is to stay informed, feel connected, and be able to discuss topics with friends or family, rather than for educational or work purposes.

Project relevance was the single motivating factor for our audience sharing tech TV news channel insights with their teams. However, 100% said they were neutral about doing so. Again, this may be due to low trust in mass media. A 2024 Gallup poll found that trust in mass media sits at 31%, suggesting our audience shares selectively from specific channels, outlets, or anchors.

It’s also possible that marketing leaders’ motivation for watching TV news is not strongly connected to their work. This would be in keeping with the American Press Institute and Associated Press-NORC Center for Public Affairs Research’s Media Insight Project. The project found that the main motivation among 16 to 40-year-olds for watching news is to stay informed, feel connected, and be able to discuss topics with friends or family, rather than for educational or work purposes.

How Do TV News Channels Influence Your Perception Of Global Markets?

100% of marketing leaders are neutral regarding TV news channels emphasizing innovation Our entire audience agreed on how TV news channels influence their perception of global markets: Although 100% of our audience said the TV news channels they watch influence their perception of global markets by emphasizing innovation, this was in neutral rather than informative ways.

One of the possible reasons for marketing leaders emphasizing neutrality in this regard is highlighted by a 2023 arXiv study, which revealed that broadcast news no longer encourages a sense of shared reality. Instead, the stories covered by cable network news channels and their framing of global issues are becoming increasingly divergent, leaving audiences with fragmented perceptions.

Although 100% of our audience said the TV news channels they watch influence their perception of global markets by emphasizing innovation, this was in neutral rather than informative ways.

One of the possible reasons for marketing leaders emphasizing neutrality in this regard is highlighted by a 2023 arXiv study, which revealed that broadcast news no longer encourages a sense of shared reality. Instead, the stories covered by cable network news channels and their framing of global issues are becoming increasingly divergent, leaving audiences with fragmented perceptions.

How Do Tech TV News Channels Affect Your Understanding Of Customer Expectations?

100% of marketing leaders say tech TV news channels influence trust levels Tech TV news channels’ influence on understanding customer expectations is the same for all marketing leaders: Our audience was unanimous when discussing how the tech TV news channels they watch affect their understanding of customer expectations. 100% of marketing leaders said the channels influence trust levels, suggesting that TV news still influences trust between brands and customers, even if neither has particularly strong faith in the media.

Despite our audience’s unanimity, there’s no indication of how much TV news influences trust. There’s a good chance the level of influence may be much lower than that of social media.

An older study published in the Journal of Service Research highlights how, in the past, customers were passive receivers of companies’ marketing efforts. Social media has changed this by turning marketing and brand relations into a conversation between brands and customers, allowing consumers to play a more active role and for both parties to base their trust on interactions rather than TV news.

Our audience was unanimous when discussing how the tech TV news channels they watch affect their understanding of customer expectations. 100% of marketing leaders said the channels influence trust levels, suggesting that TV news still influences trust between brands and customers, even if neither has particularly strong faith in the media.

Despite our audience’s unanimity, there’s no indication of how much TV news influences trust. There’s a good chance the level of influence may be much lower than that of social media.

An older study published in the Journal of Service Research highlights how, in the past, customers were passive receivers of companies’ marketing efforts. Social media has changed this by turning marketing and brand relations into a conversation between brands and customers, allowing consumers to play a more active role and for both parties to base their trust on interactions rather than TV news.

Which Strengths Do You Associate With Tech TV News Channels?

47% of marketing leaders are neutral about associating speed with the tech TV news channels they watch There are no strong opinions either way regarding the strengths associated with TV news channels: American marketing leaders had different opinions regarding the strengths they associate with the tech TV news channels they watch, although all opinions were neutral.

Almost half (47%) of our audience said they associated speed with their preferred channels. This finding is in keeping with a 2025 NewscastStudio article on trends defining broadcast and media in 2025. One of the major trends identified was accelerated content creation in response to growing demands for more content across platforms, even though it acknowledges that live sports and news are exempt from this trend due to their unique production and delivery requirements.

The rest of our audience mentioned innovation focus (36%) and expert depth (18%) as strengths. This suggests that while speed remains the most valued trait, a significant portion of viewers still look for channels that balance fast reporting with forward-thinking approaches and in-depth expertise.

American marketing leaders had different opinions regarding the strengths they associate with the tech TV news channels they watch, although all opinions were neutral.

Almost half (47%) of our audience said they associated speed with their preferred channels. This finding is in keeping with a 2025 NewscastStudio article on trends defining broadcast and media in 2025. One of the major trends identified was accelerated content creation in response to growing demands for more content across platforms, even though it acknowledges that live sports and news are exempt from this trend due to their unique production and delivery requirements.

The rest of our audience mentioned innovation focus (36%) and expert depth (18%) as strengths. This suggests that while speed remains the most valued trait, a significant portion of viewers still look for channels that balance fast reporting with forward-thinking approaches and in-depth expertise.

What Markets Does Your Company Serve When Guided By Insights From TV News Channels?

94% of marketing leaders’ companies serve a niche focus market when guided by TV news channel insights Insights from TV news channels guide companies to serve different markets: When discussing which markets their companies serve, when guided by insights from the tech TV news channels they watch, the overwhelming majority (94%) of marketing leaders said they served a niche focus market. This indicates that marketers are aware of the significant potential of niche markets.

Recent research from Accenture found that, in the last five years, venture capital investments in startups in eight countries grew by 36% to reach $361 billion. This growth rate is comparable to that of the US, which saw venture capital investments grow by 30% in the same period. More than half of these investments were directed at various markets propelled by technology.

Among those who did not share the majority’s view were 5% who said their companies served a niche avoidance market, while 1% said their companies served a national focus market. This stark disparity in numbers shows where the real focus lies.

When discussing which markets their companies serve, when guided by insights from the tech TV news channels they watch, the overwhelming majority (94%) of marketing leaders said they served a niche focus market. This indicates that marketers are aware of the significant potential of niche markets.

Recent research from Accenture found that, in the last five years, venture capital investments in startups in eight countries grew by 36% to reach $361 billion. This growth rate is comparable to that of the US, which saw venture capital investments grow by 30% in the same period. More than half of these investments were directed at various markets propelled by technology.

Among those who did not share the majority’s view were 5% who said their companies served a niche avoidance market, while 1% said their companies served a national focus market. This stark disparity in numbers shows where the real focus lies.

Which Aspects Of TV News Channels Watched Do You Find Most Valuable?

82% of marketing leaders find breaking news highly valuable Different aspects of TV news channels are considered the most valuable: Our audience made it clear that there’s an overwhelming preference for breaking news, with 82% considering this a highly valuable aspect of the TV news channels they watch. In contrast, only 10% said breaking news was somewhat valuable, while 4% said it wasn’t valuable.

Other aspects considered highly valuable scored very low, with both expert analysis and case examples only garnering 2% of opinions each. No one mentioned industry updates or predictions.

A study published in the Electronics journal found that breaking news, especially when sensationalized, attracts online users’ attention while reducing the credibility of the content and of the channel or platform sharing it. This may be one of the reasons why some in our audience did not think breaking news was valuable or preferred other aspects of the news channels they watch.

Our audience made it clear that there’s an overwhelming preference for breaking news, with 82% considering this a highly valuable aspect of the TV news channels they watch. In contrast, only 10% said breaking news was somewhat valuable, while 4% said it wasn’t valuable.

Other aspects considered highly valuable scored very low, with both expert analysis and case examples only garnering 2% of opinions each. No one mentioned industry updates or predictions.

A study published in the Electronics journal found that breaking news, especially when sensationalized, attracts online users’ attention while reducing the credibility of the content and of the channel or platform sharing it. This may be one of the reasons why some in our audience did not think breaking news was valuable or preferred other aspects of the news channels they watch.

How Do You Balance Digital Media With TV News Channels Watched?

41% of marketing leaders tend to balance digital media with TV, according to topic There are different approaches to balancing digital media with TV news channels: Based on marketing leaders’ opinions, it’s clear that there are rather different approaches to balancing digital media with preferred tech TV news channels. 41% of our audience tends to balance digital media with TV news according to topic, while 15% said they find a perfect balance this way. 22% said they struggled to balance the two according to topic.

Among those who mentioned using an equal mix of digital media and TV news, 10% said they struggled to find a balance, while just 1% said they tended to find a balance by doing this.

Some in our audience expressed a preference for digital updates. Among these, 4% said they struggled to find a balance, while another 4% said they tended to find a balance, thanks to these updates. 3% said they found digital updates provided a perfect balance to TV news.

Interestingly, the 2025 Reuters Institute for the Study of Journalism Digital News Report revealed that social media has replaced TV as the main way Americans access news. According to the report, 54% of Americans access news via social media and video networks, compared to 50% who rely on TV news and 48% who turn to news websites or apps.

Based on marketing leaders’ opinions, it’s clear that there are rather different approaches to balancing digital media with preferred tech TV news channels. 41% of our audience tends to balance digital media with TV news according to topic, while 15% said they find a perfect balance this way. 22% said they struggled to balance the two according to topic.

Among those who mentioned using an equal mix of digital media and TV news, 10% said they struggled to find a balance, while just 1% said they tended to find a balance by doing this.

Some in our audience expressed a preference for digital updates. Among these, 4% said they struggled to find a balance, while another 4% said they tended to find a balance, thanks to these updates. 3% said they found digital updates provided a perfect balance to TV news.

Interestingly, the 2025 Reuters Institute for the Study of Journalism Digital News Report revealed that social media has replaced TV as the main way Americans access news. According to the report, 54% of Americans access news via social media and video networks, compared to 50% who rely on TV news and 48% who turn to news websites or apps.

Which City In The USA Do You Live In When Watching Tech TV News Channels?

27% of US marketing leaders might live in New York City when watching TV tech news channels The distribution of marketing leaders across the US reveals specific patterns: In our audience, 27% might live in the Big Apple, 13% are unlikely to live there, and 9% definitely live there. 4% were unlikely to live in Austin, while 23% might live there, and 8% definitely live in the Texan city. Of those who mentioned Seattle, 5% might live in the city, compared to 4% who are definite residents.

Those who mentioned Los Angeles either might (2%) or definitely (2%) live in the City of Angels, while 1% of those who named San Francisco might live there, compared to 2% who definitely live in the Golden City. This shows a majority in NY, which is considered the world’s biggest business hub, with a smaller presence in other major cities across the US.

In our audience, 27% might live in the Big Apple, 13% are unlikely to live there, and 9% definitely live there. 4% were unlikely to live in Austin, while 23% might live there, and 8% definitely live in the Texan city. Of those who mentioned Seattle, 5% might live in the city, compared to 4% who are definite residents.

Those who mentioned Los Angeles either might (2%) or definitely (2%) live in the City of Angels, while 1% of those who named San Francisco might live there, compared to 2% who definitely live in the Golden City. This shows a majority in NY, which is considered the world’s biggest business hub, with a smaller presence in other major cities across the US.

Digital Sources Overtaking Traditional Channels

Overall, our insights derived from marketing leaders’ discussions online are in keeping with various studies and surveys that found a shrinking preference for and trust in TV news channels. They seldom share insights from tech TV news channels, and when they do, the content shared tends to be neutral and relevant to specific projects, breaking news, or related to competitor strategies, market shifts, or customer trust. This indicates most marketing leaders see TV news as a somewhat useful optional extra, prefer to get industry-related news updates from digital sources, and gain customer insights from platforms such as social media. It’s likely that, in the coming years, TV news will play an ever-diminishing role in marketing, business strategy, and customer insights.Methodology

Sourced using Artios from an independent sample of 4,485,377 United States marketing leaders’ opinions across X, Reddit, TikTok, LinkedIn, Threads, and BlueSky. Responses are collected within a 95% confidence interval and 2% margin of error. Results are derived from opinions expressed online, not actual questions answered by people in the sample. About the representative sample:- 42% of US marketing leaders are between the ages of 45 and 64.

- 60% identify as male and 40% as female.

- 40% earn between $200,000 and $500,000 annually.